There are a large number of interdependent and overlapping issues relating to VAT on financial services (broadly defined) and investment management companies.

The starting point here is sec. 4 no. 8 of the German VAT Act (UStG), according to which certain, but not all, transactions in the financial sector are exempt from VAT. It must therefore be precisely defined whether a particular supply of services is exempt or not. This must be assessed individually on the basis of the supply provided.

If the transactions are VAT exempt, it must be considered whether an option for VAT, pursuant to sec. 9 para. 1 of the German VAT Act, is both possible and reasonable. This question is closely related to the next problem area, namely input VAT deduction. It is not possible to deduct input VAT from purchased input supplies if these input supplies are used for VAT exempt output transactions. Taxable persons operating in the financial sector therefore regularly waive the VAT exemption - as far as possible - in order to continue to benefit from the input VAT deduction.

However, there are also alternative ways to improve the VAT situation: eg, it may be advisable to use a VAT group’s controlled company, rather than a subcontractor, due to the restrictions on input VAT deduction. In the cross-border context, fixed establishments are also of considerable importance, especially in the banking sector.

Finally, especially in the case of modern supplies of financial services, the question regularly arises as to which relationships exist between whom. This applies, in particular, to so-called fintechs, ie companies that offer technology-based applications in the financial sector (eg supplies of payment processing, payment initiation and account information services). In view of the multi-party relationships that often exist, the first question to be addressed is what the exact nature of the relationships are in the actual circumstances and whether a commission arrangement may be involved.

In the insurance sector, the legal issues mentioned – with the exception of those legal issues relating to the waiver of VAT exemption – also arise. In addition to the points already mentioned, the area of supply of intermediary services is of particular interest in relation to insurance. For example, the supplies of a (non-typical) Assekuradeurs (underwriting agent) have been scrutinised in jurisprudence. VAT exemption is also repeatedly disputed when several intermediaries are involved in brokering an insurance policy.

1. VAT exemption in accordance with sec. 4 no. 8 lit. a to g of the German VAT Act

In accordance with sec. 4 no. 8 lit. a to g of the German VAT Act, various financial transactions are VAT exempt. These include, for example, the granting of loans, current account transactions, payment and transfer transactions, supplies of securities and the transfer of company shares. In addition, the supply of intermediary services for the aforementioned financial transactions is also exempt from VAT.

The financial transactions mentioned relate, in particular, to traditional banks. However, they are by no means limited to these. In fact, it is not a requirement for VAT exemption that a bank is engaged in these business activities. Registration or a licence from BaFin, be it a banking licence, a payment institution licence or an e-money licence, is not a prerequisite for VAT exemption.

a) Example: payments and transfers

Inter alia, transactions, including negotiations, payments and bank transfers, are exempt from VAT. It is not uncommon for several companies to be involved in the processing of payment and transfer transactions. Fintechs are also particularly active in the area of simplifying transfer transactions.

In this respect, the question repeatedly arises as to whether the assumption of isolated activities in connection with the execution of payments or transfers is covered by the VAT exemption or not. Examples from jurisprudence include the operation of bank ATMs (German Federal Fiscal Court, judgment of 13 November 2019 – V R 30/19; see also NL 41/2019) and the involvement in the processing of card payments (ECJ, judgment of 26 May 2016 – C-607/14). Most recently, the German Federal Fiscal Court had to decide as to whether the issuance of stadium payment cards could be exempt from VAT. The German Federal Fiscal Court affirmed this (German Federal Fiscal Court, judgment of 26 January 2022 – XI R 19/19; NL 25/2022).

With regard to outsourced supplies of services, recipients, in particular, often have an interest in VAT exemption. Since a bank, in its capacity as a principal, generally provides VAT exempt output supplies, when making payments or transfers, it is not entitled to input VAT deduction for such outsourced activities.

However, in order to fall within the scope of the VAT exemption, the outsourced activities must form a distinct whole and result in the transfer of a sum of money. Purely supporting supplies of services, on the other hand, are not covered by the VAT exemption. In practice, it is always essential for tax lawyers in such cases to determine precisely what happens and how responsibilities are divided between the parties involved.

b) Example: Factoring

Within the framework of factoring, a creditor (known as a factoring client) transfers a debt to the factor. In return, the factoring client receives, from its factor, immediate payment of the debt amount minus a retention fee.

Various supplies and types of supplies may be involved in factoring. With regard to “whether or not” VAT exemption applies, it should be noted that the collection of debts is not exempt from VAT, whereas the granting of credit in connection with this is.

In genuine factoring, the factor takes over the collection of debts and the default risk from the factoring customer. In principle, this supply of services is subject to VAT. The factor collects the debt. The assignment of the debt is not taxable. The granting of credit through immediate payment by the factor is, however, generally of secondary importance.

The same opinion applies, in principle, to so-called non-genuine factoring. In contrast to genuine factoring, the factor does not assume the default risk from the factoring client.

The situation will only be different if the factoring client continues to collect the debt itself. In such cases, the factor grants a credit (VAT exempt supply with the possibility of waiving the VAT exemption). The customer assigns a debt as consideration. This is a barter-like transaction with a supplementary cash payment. The income tax or commercial law treatment of this transaction is irrelevant.

Different results may arise if non-performing debts are sold. These are debts that are more than 90 days past due or have been terminated or may potentially be terminated.

c) Example: Loan transactions

The granting of loans is exempt from VAT. On the one hand, such credits are granted between unrelated third parties (eg a bank to a customer, but also in the context of bank refinancing, see NL 41/2022). On the other hand, such loans are often granted within a group or between affiliated companies.

Within a group of companies, on the one hand, long term loans are granted. On the other hand, loans are also granted within the framework of a cash pool. Cash pools come in various forms. Often, the cash pool is structured in such a way that the bank accounts of the participating group companies (cash pool participants) are balanced on a daily basis with the bank account of the cash pool leader.

If the cash pool leader offsets a negative account balance, it grants a loan to the corresponding company. The participant must pay interest on this loan. This transaction is exempt from VAT. The same applies if the cash pool leader receives a positive balance. In this case, the participant provides a VAT exempt credit.

Such facts must be identified and then taken into account accordingly with regard to input VAT deduction. It is also necessary to consider how the facts can be best structured with regard to input VAT deduction (option to pay VAT, VAT group, involve third-country companies, etc).

In connection with the granting of loans by banks, credit consortia have recently been the subject of much discussion. In this case, various banks grant loans to a company or group of companies in a coordinated manner. One of the banks coordinates this lending as the consortium leader and receives remuneration for performing this task.

Such a transaction does not fall within the wording of sec. 4 No. 8 lit. a of the German VAT Act (UStG). It is therefore taxable. However, Art. 135 para. 1 lit. b and c of the European VAT Directive considers the management of credits and credit guarantees to be exempt from VAT. As a result, the draft Future Financing Act and the draft Annual Tax Act 2024 originally both provided that such supplies of services by a syndicate leader should also be VAT exempt. However, this regulation was ultimately deleted by the Finance Committee due to fears of potential tax losses.

d) Example: transfer of company shares

The transfer of company shares is also exempt from VAT. However, the requirement is that the transfer is made by a taxable person within the scope of his business. According to the tax authorities, this depends on whether the company shares were previously held as part of the business activity itself (sec. 15.22 para. 2 sentence 2 of the German Administrative VAT Guidelines). However, the ECJ may take a different view.

The question is particularly interesting because of the choice to opt for taxation. This choice only exists if the supplies are taxable but exempt. Only by waiving the VAT exemption is it possible to deduct input tax from, for example, sales costs.

2. VAT exemption in accordance with sec. 4 no. 8 lit. h of the German VAT Act

The VAT exemption, in accordance with sec. 4 no. 8 lit. h of the German VAT Act, applies to the managers of funds and pension schemes within the meaning of the German Insurance Supervision Act (VAG). In this respect, however, a licence to operate as a capital management company, in accordance with the German Capital Investment Code (KAGB), for example, is not a requirement for VAT exemption.

In order for supplies of these services to be VAT exempt, they must be provided by an organisation/fund or a corresponding pension fund referred to in sec. 4 no. 8 lit. h of the German VAT Act. The particular supply of services itself must also constitute “management” within the meaning of the standard.

Undertakings for Collective Investment in Transferable Securities (UCITS) are securities funds. The requirements for such special investment funds are set out in detail in sec. 1 para. 2 of the German Capital Investment Code (KAGB).

According to the wording of the law, valid up until 31 December 2023, the management of alternative investment funds comparable to UCITS, within the meaning of sec. 1 para. 3 of the German Capital Investment Code (AIF), is also VAT exempt. Such AIFs include property funds, private equity funds and crypto funds. These funds can be part of a capital management company (KVG) in the form of a special fund, or exist in the legal form of an investment stock corporation or an investment limited partnership.

With regard to AIFs, it proved to be challenging to determine, under VAT law, up until 31 December 2023, whether AIFs were comparable to a UCITS (see most recently ECJ, judgement of 5 September 2024 - Case C-639/22; NL 36/2024). The main issue here was whether an AIF was an open-ended or closed-ended fund and whether it was only open to professional or semi-professional investors (special AIF) or also to other investors.

For some time now, the law has explicitly named so-called venture capital funds as a type of “favoured” AIF. In this respect, the (complete) comparability with a UCITS no longer had to be examined. However, the German Federal Ministry of Finance set out a number of requirements in order for a fund to be considered a venture capital fund.

The problem regarding the identification of beneficiary AIFs has been resolved since 1 January 2024. Due to an amendment to the German VAT Act by the Future Financing Act, the criterion of similarity no longer applies. From this date, the management of all AIFs is VAT exempt. As a result, the legislator is harmonising German VAT law with that of various other EU Member States.

The main problem with the VAT exemption provision is therefore likely to be the question of whether the supplies provided are deemed to be “management”. The outsourced tasks must form a broadly distinct whole and be specific and essential for the management of investment assets (NL 25/2021).

For example, the provision of purchase and sale recommendations, portfolio management, risk management and security management can all be VAT exempt. However, a distinction must be made in the case of supplies of management services. The supply of general advisory services to the fund, the actual management of properties (“caretaker activities”) and the distribution of shares are not VAT exempt. Sec. 4.8.13 of the German Administrative VAT Guidelines lists a number of examples.

It is conceivable that individual activities, which are taxable when considered in isolation, may form part of an overall VAT exempt service. Accordingly, if a capital management company (KVG) provides VAT exempt supplies of management services to an AIF it manages, it is conceivable that certain activities, which would otherwise be taxable on their own, may be considered part of a VAT exempt overall supply.

Before the question of VAT exemption can be clarified, it must be determined who is actually providing supplies to whom. If the UCITS or AIF is a special fund formed by a KVG, the KVG provides supplies of management services to the investors (Federal Fiscal Court, judgement of 16 December 2020 - XI R 13/19, NL 17/2021). At the same time, in the case of a property investment fund, for example, the KVG provides rental service supplies to third parties (using the investment fund’s properties).

Despite the taxable output transaction generated by the rental services, the Federal Fiscal Court recently decided, in the aforementioned judgment, that VAT deduction, from certain procured goods and services, is not possible, at all, for the relevant funds. In our view, this is incorrect, as the expenses in question represented imputed costs attributable to the letting supplies.

If, on the other hand, it is a legally independent investment stock corporation or an investment limited partnership, the investment company can manage itself. Such an internally managed investment company does not provide any supplies to investors through its management. However, if the investment company commissions a KVG to handle its management, this KVG provides supplies of management services to the so-called externally managed investment company.

Irrespective of this distinction, a managing KVG can commission other KVGs to provide supplies of management services. This may, for example, involve assuming certain provisions in relation to certain countries or sectors. Such supplies may also be VAT exempt.

3. Input VAT deduction

The reverse side of the described VAT exemption concerns the input VAT deduction. Depending on whether the taxable person provides exclusively or only partially VAT exempt output transactions, the input VAT deduction is either fully or partially excluded pursuant to sec. 15 para. 2 sentence 1 no. 1 of the German VAT Act.

Taxable persons with VAT exempt supplies, pursuant to sec. 4 no. 8 of the German VAT Act, often also carry out such supplies across the border in another Member State or a third country. If the place of supply is located in another Member State, this generally does not affect the exclusion from input VAT deduction. The input VAT deduction remains excluded, even if the taxable person would not be entitled to deduct input VAT for a corresponding supply with a place of supply in Germany, under the German VAT Act (sec. 15 para. 2 sentence 1 no. 2 of the German VAT Act).

However, this does not apply – except in the case of fund management – if the place of supply is in a third country (sec. 15 para. 3 no. 2 lit. b of the German VAT Act). In such cases, the taxable person remains entitled to deduct input VAT, even if the supplies would, from a German perspective, be VAT exempt.

For input VAT deduction purposes, it may therefore be advantageous if a supply can initially be provided to a recipient in a third country. However, such deliberate structuring often fails due to excessive effort, eg in organisational terms, or because it is practically impossible.

In addition to the financial consequences, in practice, a proportional input VAT exclusion, in particular, leads to increased effort and makes it necessary to adjust internal processes. When posting procured goods and services, a distinction should be made as to whether an input supply can be directly attributed to taxable output transactions – and is therefore entitled to input VAT deduction– or whether it can be attributed to VAT exempt output transactions.

From a legal perspective, it must then be considered whether the input VAT ratio for general costs should be determined on the basis of an allocation key.

In the banking sector in particular, it is conceivable to determine the input VAT ratio using a margin key, insofar as the bank acts as an intermediary. In the case of lending, for example, the margin is roughly calculated on the basis of the difference between the interest rates for borrowing and lending. The Federal Ministry of Finance recently commented on this in a letter dated 9 December 2024.

However, any other allocation key (for example based on turnover or personnel) is also conceivable, insofar as it is appropriate. The taxable person is free to choose the key it wishes to use. The tax authorities may check whether the input VAT ratio has been calculated correctly.

Finally, in the case of proportionally VAT exempt output transactions, it must be monitored to what extent the input VAT ratios change. In this case, a correction must be made in accordance with sec. 15a of the German VAT Act. This is often more of a practical than a legal problem.

4. VAT group/fixed establishments

Banks and insurance companies, in particular, regularly outsource certain activities to subcontractors. Input VAT amounts invoiced by subcontractors to a bank or insurance company are often not deductible or are only deductible on a pro rata basis. Due to the input VAT exclusion, it makes sense, particularly in the banking and insurance sector, to form VAT groups or establish fixed establishments.

a) VAT group

If the service provider is a controlled company, it can invoice its supplies not showing VAT. In this case, there is a proportional input VAT exclusion (in the following example, from office equipment) for the controlled company. However, there are cost advantages in terms of the calculated costs for the personnel employed, other input VAT burdened procured goods and services and the profit margin of the subsidiaries.

If, in the above example, no VAT group was in place, the subsidiary’s supplies to the insurance company would be subject to VAT. The taxable amount would be the full remuneration, including the personnel cost component and profit margin. As the insurance company is not entitled to deduct input VAT, the VAT constitutes a final cost factor for it.

Due to the cost elements involved, this VAT burden is significantly higher than the input VAT loss at the level of the subsidiary. In this case, the VAT group can therefore at least reduce its input VAT loss.

b) Fixed establishment

Companies in the insurance or financial services sector often operate across Europe. If such activity is carried out within the framework of a “fixed structure” on site, the organisational question arises as to whether a subsidiary or a fixed establishment should be established.

A subsidiary has the disadvantage that (due to the lack of cross-border VAT group effects) supplies between companies within a group are subject to VAT. For this reason, fixed establishments are often used. These have the advantage that supplies of services between two fixed establishments or between a fixed establishment and the head office are non-taxable. However, there is also a downside in this respect: input VAT exclusions of the parent company or fixed establishment, due to VAT exempt output transactions, can have an impact on the procured goods and services of the other part of the company (see NL 06 | 2019 on the ECJ judgment Morgan Stanley [Case C-165/17], which is still relevant today).

Problems typically arise in the sector of fixed establishments when a supply (eg software) is purchased by a head office or fixed establishment in a country with (often) low tax rates and then distributed to the (other) fixed establishments. In this case, the question arises as to whether the supply was actually purchased by the head office or directly by the individual fixed establishments. The solution depends on the individual case.

Another problem arises in this context from the jurisprudence of the ECJ in the Skandia (judgment of 17 September 2014 – Case C-7/13) and Dankse Bank cases (judgment of 11 March 2021 – Case C-812/19, see NL 08 | 2021). According to the judgments, if the fixed establishment is part of a VAT group, supplies provided to it by fixed establishments in other countries are also taxable.

This jurisprudence applies, in any case, if the recipient fixed establishment is located in Sweden. It is unclear as to whether and how this jurisprudence applies to recipient fixed establishments that are located in Germany. The German tax authorities have not implemented this jurisprudence. The German Administrative VAT Guidelines state the opposite.

5. Waiver of VAT exemption

In certain cases, it is possible to waive the VAT exemption and thus avoid the input VAT issue described above. This applies to most VAT exempt supplies in the financial services sector (with the exception of the management of UCITS, AIFs and pension funds under the VAG). Insurance companies do not have the choice of opting for VAT.

The option is only available if the recipient is a taxable person and the supply is purchased for their business. For example, a bank can waive the VAT exemption if it grants loans to taxable persons for their taxable sector. Subcontractors and fintech companies also regularly offer their supplies (exclusively) to taxable persons. In this case, they too can opt for their activities to be taxable, insofar as their supply is VAT exempt. For this purpose, it is sufficient to indicate the VAT for the service in question on the invoice and to pay the corresponding VAT.

The advantage of this option is that it allows a supplier to claim input VAT deduction. This can be illustrated most easily with an example:

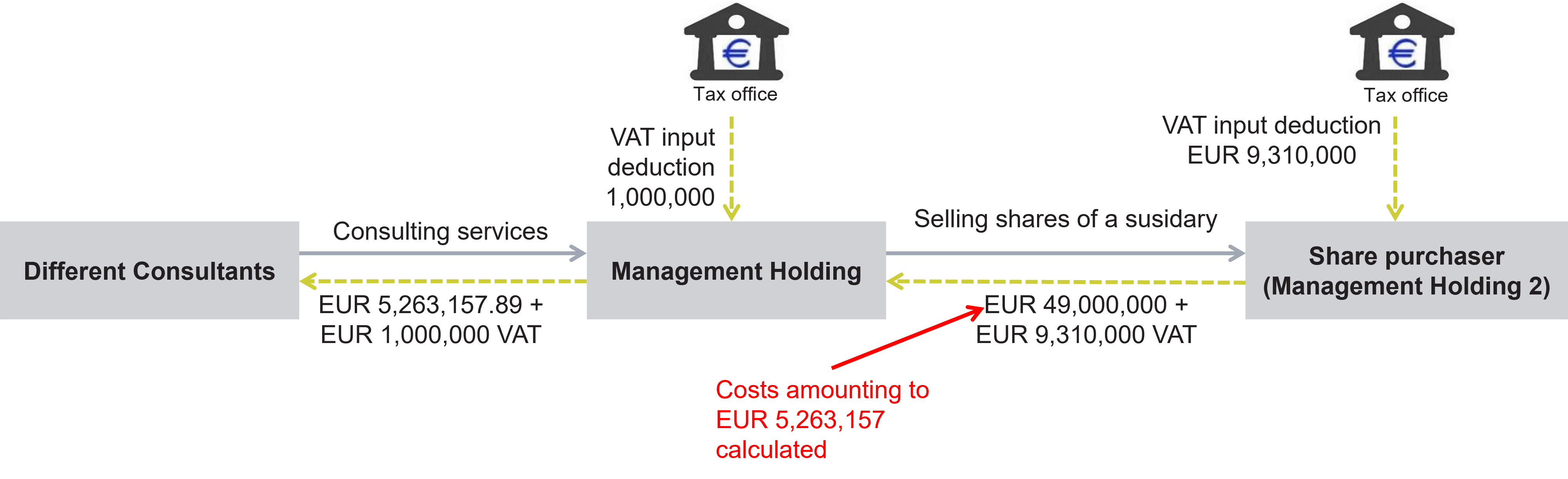

A management holding company is a company that holds shares in subsidiaries and provides supplies to them for consideration. The management holding company thus holds the shares in the taxable sector. If it sells such shares, this sale is generally taxable but VAT exempt. The management holding company is therefore not entitled to input VAT deduction from costs associated with the sale (eg supplies of consulting services).

The management holding company must therefore include the selling costs plus VAT in the selling price. As the supply is VAT exempt, the share purchaser is not entitled to input VAT deduction. As a result, he is also charged with the VAT from the selling costs.

If the share purchaser is himself a taxable person who uses the shares for his company (in the example: the share purchaser also plans to carry out supplies to the subsidiary for consideration), this burden can be avoided.

By waiving the VAT exemption, the management holding company is entitled to claim input VAT deduction from the procured goods and services in connection with the sale. It can therefore calculate the selling costs on a net basis. The VAT shown in the invoice can be claimed as input VAT by the share purchaser in his capacity as a taxable person. This means that he is not burdened by it.

In our example, this means that the cost of purchasing the shares is only EUR 49,000,000 instead of EUR 50,000,000.

In practice, in such situations, the seller should also take precautions from the outset to ensure that he can prove that he wishes to sell the shares using the VAT exemption waiver. If the sale fails, this will at least enable input tax to be deducted from the wasted consulting costs.

It is important to note that, in most cases, the waiver of VAT exemption in the financial sector is not available in “cross border cases”. As explained above, input VAT deduction is also excluded if the supplier renders a supply in another Member State that would be VAT exempt in Germany, if the place of supply was in Germany. If a bank grants a loan to a taxable person based in another Member State, it cannot simply declare this transaction as “taxable” and thereby improve its input VAT ratio.

6. Relationships/commission

If three or more legal entities are involved, special VAT questions arise. In these cases, in particular, the first step is to determine who the supplier is and who receives the supply.

This can be particularly difficult in the case of fintechs. These companies generally offer their customers a supply of services related to bank accounts or traditional supplies of financial services (account management, transfers, credit card payments, granting of credit, etc.). However, as they do not have a banking licence themselves, they cooperate with a corresponding institution in this regard. Customers are only required to pay the fintech.

For VAT purposes, it is necessary to examine who provides what type of supply to whom and who pays whom for this supply. For example, it is conceivable that a fintech company, in addition to supplies of services rendered to a customer, carries out supplies of intermediary services to a cooperating bank.

There is no blanket solution for such constellations. Rather, an examination of the actual economic circumstances, on a case-by-case basis, must be conducted.

7. Insurance/insurance brokerage

Some of the above problems also arise in the insurance sector. For example, it must be clarified whether a transaction actually falls under the Insurance Tax Act (see sec. 4 no. 10 lit. a of the German VAT Act) or whether a person is provided with insurance cover (see sec. 4 no. 10 lit. b of the German VAT Act).

Most recently, the German Federal Ministry of Finance issued a letter dated 11 May 2021 commenting on the extent to which warranty commitments made by a car dealer are subject to the Insurance Tax Act and are therefore exempt from VAT (NL 18|2021). This is relevant because the dealer’s customers are entitled to deduct input VAT but may nevertheless prefer to be charged VAT, as they are entitled to deduct input VAT in this respect (unlike with insurance tax).

Unlike with supplies under sec. 4 no 8 of the German VAT Act, however, a waiver of VAT exemption is not possible within the scope of the VAT exemption for insurance transactions. The input VAT exclusion cannot therefore be avoided in this way. This makes the mentioned issues, concerning the VAT group and fixed establishment, all the more interesting.

Insurance brokerage is a recurring subject of legal disputes. Under national law, the activity of an insurance agent or insurance broker is VAT exempt (sec. 4 no. 11 of the German VAT Act). The insurance company also has a considerable interest in this VAT exemption, at least due to the input VAT exclusion.

Despite the wording of the law, as to whether someone acts as an insurance broker or agent, is not determined by their formal position. In particular, a licence from the Chamber of Industry and Commerce or a corresponding registration are not crucial for VAT purposes. Rather, it is the activity as such that is crucial. This must be insurance brokerage.

An insurance brokerage is always deemed to exist, when a taxable person, who is not a party to the contract, ensures that two parties conclude an insurance contract. However, no supply of brokerage services is rendered, if there is no specific and essential connection to an insurance company (eg “only” an advertising banner on a homepage with a corresponding link to the insurance company). The German Federal Fiscal Court (BFH) recently dealt with a special aspect in connection with an underwriting agent (BFH, judgment of 22 June 2021 – V R 10/21), although the case in question deviated significantly from a “normal case”.

In this respect, there is naturally a large grey area between the presentation of a specific insurance contract offer on the one hand (brokerage), and general advertising for insurance (no brokerage), on the other. There is no specifically defined boundary here.

If an insurance intermediary carries out a VAT exempt supply of brokerage services, activities such as portfolio management, in return for corresponding commissions, these are also VAT exempt. However, purely back-office activities, such as the sole processing of claims or insurance applications submitted to the insurance company, are not VAT exempt.

Things always get interesting in the sector of insurance brokerage when several independent intermediaries, working in a structured sales organisation, are involved in the brokerage. For example, one of the intermediaries is on site with the customer. The superior intermediary, who recruited him, forwards the signed application for insurance to the relevant insurance company (via a sales organisation, if applicable). Any number of parties may act as intermediaries in this process.

In such constellations, it is clear that the intermediary acting on site renders VAT exempt supplies of intermediary services. The other parties acting as intermediaries carry out VAT exempt supplies of intermediary services if they can potentially influence each individual contract offer. By supporting, training and supervising the subordinate insurance intermediaries, they also carry out supplies of intermediary services in this case.