1 Background

The Federal Ministry of Finance (BMF) has finally made up its mind and published a number of Federal Fiscal Court (BFH) judgments, some of which were already issued ten years ago. These judgments address the important question of whether and to what extent input VAT deduction should be denied when activities generating permanent deficits are being carried out. The problem for the tax authorities is obvious: in these cases, there are often ‘input VAT surpluses’ caused, in part, by the fact that companies, associations or legal entities are able to offer below-cost prices on the market due to subsidies. Nevertheless, they are entitled to full input VAT deduction when engaged exclusively in economic activity. This development in case law began with the ECJ ruling in the Gemeente Borsele case, in which the ECJ denied input VAT deduction for school transport with a cost recovery rate of only 3% in 2016. Without citing this ruling, the BMF intends to deny the status as taxable person in such extreme cases (cost recovery rate of 3%) in future. In a letter dated 20 January 2026, the BMF now provides clear guidance on when the status as taxable person must be denied.

2 Two-stage examination by the BMF

In the case of activities that are permanently loss-making, a two-step examination should be carried out – in line with the general order of examination in VAT: First, the supply of goods or services for consideration must be examined in accordance with Section 1 of the German VAT Act, and in a further step, the status as taxable person is to be assessed in accordance with Section 2 of the German VAT Act.

The BMF does not impose any major constraints on the supply for consideration. It is only rejected in the case of purely symbolic payments. In practice, this will rarely be the case. It is not sufficient for the payment to be lower than the cost of the supply. In 2022, the BFH rejected a supply for consideration in the case of the leasing of a swimming pool for a fee of EUR 1.

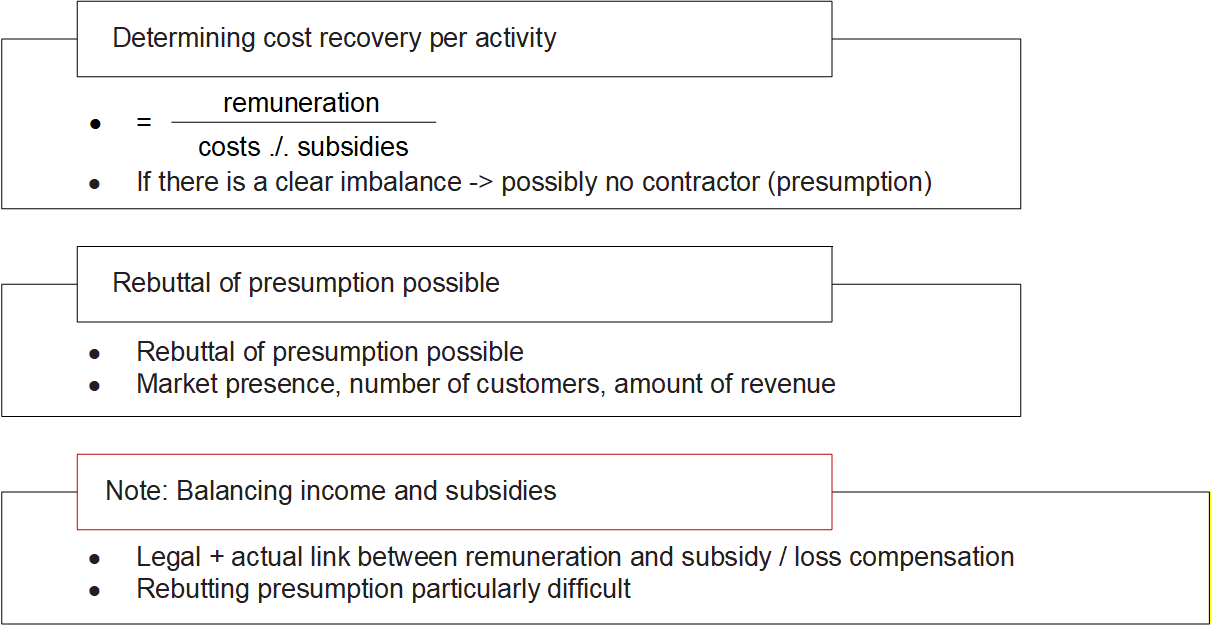

The BMF's comments on the question of status as taxable person are of greater interest. Here, an overall assessment of the circumstances of the individual case is decisive. This is, for practical purposes, often a difficult undertaking. The BMF wants us, as part of the overall assessment, to compare the circumstances under which the alleged operator provides the service in question with the circumstances under which such a service is usually provided. Particular caution is required in the event of a so-called asymmetry between costs and revenues. At least the BMF supports those applying the law with the following assessment scheme. The BMF works with presumptive assumptions here.

3 Date of application

The BMF is granting those affected a very generous transitional arrangement: if there is an asymmetry between revenue and costs, it will not raise any objections in this regard until 31 December 2027 – including for input VAT deduction purposes – if a status as taxable person is assumed. The situation is different only if the contracts have been extended or newly concluded after the publication of this BMF letter.

4 Consequences for the practice

Companies or institutions that can only offer their products at low prices on the market with the help of subsidies or loss compensation now need to take concrete action. They must take measures to remain fully entitled to input VAT deduction. They now have two years to adjust their contracts or business models. Otherwise, they risk having to make input VAT adjustments, in accordance with Section 15a of the German VAT Act, for pre-existing investments Non-profit organisations and local authorities are particularly affected, as they often base their pricing on the 'public welfare'. But as is so often the case, the jug goes to the well until it breaks. In other words, if everything remains within reasonable limits or the circumstances of the individual case are well documented, nothing should happen.

Contact