The customs value is the basis for the assessment of customs duties. It determines the value of goods at the time of importation. The customs value also flows into the assessment base for import VAT.

Foundation in international law

The European customs valuation is derived from the WTO Agreement "Agreement on Implementation of Article VII of the General Agreement on Tariffs and Trade (GATT) 1994." This agreement forms the basis for customs valuation in all WTO member states. It mandates the application of the transaction value method as the primary valuation method and regulates the application of subsidiary methods in a hierarchical order. The aim of the agreement is a uniform, fair, and transparent system for valuing imported goods, which is based on actual economic circumstances and excludes arbitrary customs values.

The World Customs Organization (WCO) has published numerous case studies and explanations regarding such constellations in its Customs Valuation Compendium. These documents, including advisory opinions and explanatory notes, serve to harmonize the interpretation of the WTO Customs Valuation Agreement and are of considerable practical importance, even if they are not formally binding.

Transaction value method (Art. 70 UCC)

The primary method for determining the customs value is the transaction value method according to Art. 70 UCC. It is based on the actually paid or payable price for the imported goods within the framework of a sale for export to the customs territory of the Union. The transaction value thus determined is, if necessary, to be corrected by additions or deductions.

The decisive factor is the agreed price of the transaction that took place immediately before the goods entered the customs territory of the Union (Art. 128 para. 1 UCC-IA). Determining the relevant transaction is regularly of great importance. The EU Commission provides a non-exhaustive list of examples as a valuation aid. It must always be checked on a case-by-case basis whether an example applies or exceptions are present.

In the basic case, only one transaction takes place. The relevant transaction is transaction A – B:

Especially when there are several transactions between multiple parties, determining the relevant transaction sometimes requires closer examination.

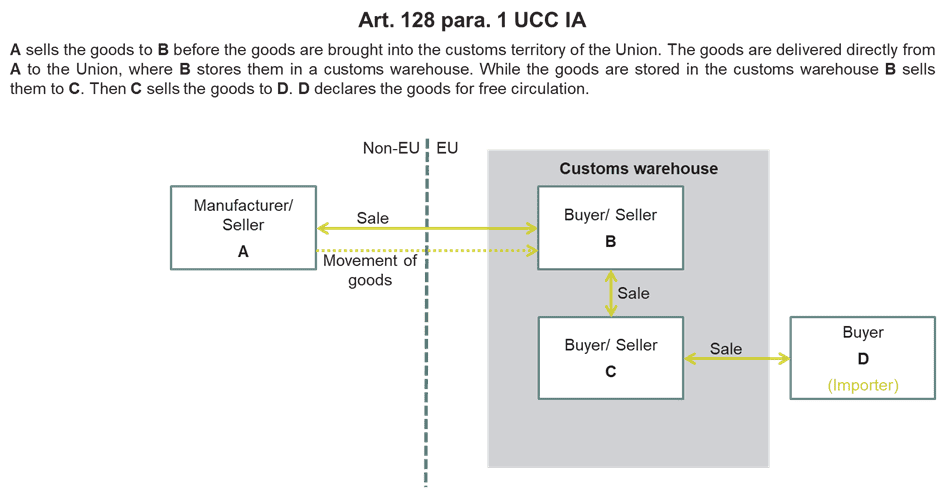

In the following example, transaction B – C is the relevant one:

The transaction between A and B does not yet lead to the export of the goods to the customs territory of the Union. Neither does the transaction between C and D. However, it is possible that the export to the customs territory of the Union will take place as a result of the sale between A and B. The transaction may be decisive even if both parties are based outside the EU.

Special circumstances may also arise in connection with special customs procedures, e.g., the customs warehousing procedure. The relevant transaction is generally the one that leads to storage in the customs warehouse, as this is where the goods are exported to the customs territory of the Union. Release for free circulation is not necessary. In this case, transaction A – B is therefore relevant:

However, this requires that the importer (D) has access to the information from purchase transaction A – B. Otherwise, the customs value cannot be determined on the basis of this transaction.

Additions (Art. 71 UCC)

Certain costs are to be added to the transaction value, provided they are not already included in the purchase price:

Commissions and broker’s fees (except for buying commissions)

Costs for containers and packaging

Assists (e.g., tools, plans, designs)

Royalties, if they are paid as a condition of the sale

Proceeds from resale that benefit the seller

Transport, loading, and insurance costs up to the place of introduction

Example:

A company imports machines from the USA. The purchase contract additionally stipulated that it pays royalties for a patent required for the machines. These royalties must be added to the customs value if they are not already included in the purchase price.

Deductions (Art. 72 UCC)

The following are not to be included in the customs value, among others:

Costs incurred after the place of introduction (e.g., domestic transport)

Interest from financing transactions

Assembly or maintenance costs after importation, provided they are listed separately

Another practically relevant area of customs valuation concerns so-called separated price elements, i.e., price components that are not directly included in the main purchase price, but may still be relevant for customs value. This particularly applies to certification, testing, and analysis costs incurred in connection with the importation. According to the customs value directive (VSF Z 5101), a separated purchase price is always present if the seller is contractually or legally obliged to perform an activity related to the imported goods and an additional payment is made for this activity – regardless of whether this payment is made directly to the seller or to third parties.

Typical examples are costs for compliance with technical standards (e.g., CE marking, TÜV certification) or for analyzing ingredients. According to Art. 70 para. 2 UCC, these costs are to be added to the customs value if they are a condition for the sale and are not provided separately for services after importation. In contrast, additional checks that the buyer carries out for their own purposes and outside the contractual agreements – such as incoming inspections or own laboratory analyses – are not relevant for customs value, provided they are carried out exclusively for internal purposes.

Secondary customs valuation methods

If the customs value cannot be determined using the transaction value method, the UCC provides for subsidiary methods, which are to be applied in a fixed order:

Transaction value of identical goods (Art. 74 para. 2 lit. a) UCC): Comparison with identical goods imported at approximately the same time at the same commercial level. Goods from the same manufacturer take precedence.

Transaction value of similar goods (Art. 74 para. 2 lit. b) UCC): Comparison with similar goods imported at approximately the same time at the same commercial level.

Deductive method (Art. 74 para. 2 lit. c) UCC): Derivation of the customs value from the selling price of the imported goods in the customs territory.

Computed value (Art. 74 para. 2 lit. d) UCC): Composition of production costs, profit, and other expenses.

Fallback method (Art. 74 para. 3 UCC): Application of other reasonable means of determination.

Special features regarding transfer prices

Special attention is required for the relationship between customs value and transfer prices. Transfer prices serve the distribution of profits within multinational groups. In the case of so-called year-end adjustments, i.e., subsequent adjustments to transfer prices, conflicts arise with the customs value regulations, as these do not provide for subsequent changes. Instead, the customs value must be definitively determined at the time the customs declaration is accepted.

The case law of the ECJ in the case Hamamatsu (judgment of 20.12.2017 – C-529/16) clarified that flat-rate subsequent adjustments do not affect the customs value. The customs value must be determined at the time the customs declaration is accepted. Subsequent corrections are only permissible in exceptional cases. The German Federal Fiscal Court (BFH) confirmed this line in its judgment of 17 May 2022 (VII R 2/19) and emphasized that customs valuation must be goods- and date-specific (see also KMLZ Customs Newsletter 01/2019 and 04/2022). However, the ECJ also stated that the transaction value method does not apply if the final price is not fixed at the time the customs declaration is accepted. This regularly leads to disputes regarding the correct method and exact customs value.

Contact