VAT Insolvency Law

VAT insolvency law is an interdisciplinary field combining VAT law and insolvency law. Legal expertise in both areas is essential for addressing legal issues in this legal area. In VAT insolvency scenarios, it is not uncommon for not only the tax office and the taxpayer to be involved, but also the insolvency administrator and/or the insolvency court. Often, case-specific solutions are required, as many situations in this context have not yet been adjudicated. Tax privileges granted to the fiscal authorities can quickly come at the expense of the taxpayer or the insolvency administrator. Nevertheless, this advisory field also offers room for creative structuring.

1. What is VAT insolvency law?

VAT insolvency law governs special situations involving VAT-liable entities in the event of their insolvency. Although VAT law and insolvency law are two distinct legal areas, a business facing financial distress or one that is already insolvent must comply with both VAT regulations and insolvency provisions. The VAT-specific rules that apply in the context of insolvency proceedings are collectively referred to as VAT insolvency law. However, this area of law is neither specifically nor uniformly codified. It draws on provisions from both VAT law and insolvency law, as well as from case law relating to VAT in insolvency contexts.

2. What is the purpose of VAT insolvency law?

In the event of a business’s insolvency, VAT and insolvency law provisions often do not align seamlessly. In fact, rights and obligations under insolvency law may conflict with those under VAT law. VAT insolvency law therefore serves two main purposes: First, it establishes VAT-related rules specifically for the interim period during a company’s insolvency (“interim legal framework”). Second, where conflicting provisions exist between VAT law and insolvency law, VAT insolvency law aims to resolve these conflicts (“conflict-of-law rules”).

3. Which courts handle VAT insolvency disputes?

Depending on the allocation of jurisdiction in each individual case, VAT insolvency disputes may be heard either before the fiscal courts or the ordinary civil courts. Depending on the initial jurisdiction (Regional Court or Fiscal Court), the case may ultimately fall under the jurisdiction of either the 7th Senate of the Federal Fiscal Court (Bundesfinanzhof – BFH) or the 9th Senate of the Federal Court of Justice (Bundesgerichtshof – BGH), both of which are specialized in VAT insolvency matters.

These high court rulings carry particular weight in legal practice, as many constellations in VAT insolvency law remain unregulated. Familiarity with this case law is therefore essential for the proper application of the law in VAT insolvency matters.

4. Which VAT-related issues are affected by insolvency?

The insolvency of a business can have an impact on all of its rights and obligations concerning VAT. The special circumstances of insolvency may therefore modify both substantive VAT law and procedural tax law. Accordingly, specific provisions relevant to VAT insolvency law can be found in the VAT Act (Umsatzsteuergesetz – UStG), the Insolvency Code (Insolvenzordnung – InsO), the VAT Application Decree (Umsatzsteueranwendungserlass – UStAE), the Fiscal Code (Abgabenordnung – AO), and the Application Decree to the Fiscal Code (Anwendungserlass zur Abgabenordnung – AEAO), among others.

4.1 Procedural specifics

Insolvency proceedings impose particular restrictions on tax procedures. Under German tax procedural law, the principle “insolvency law takes precedence over tax law” applies (cf. sec. 251 para. 2 sentence 1 of the Fiscal Code).

Once insolvency proceedings are opened with respect to the taxpayer’s assets, any ongoing tax assessment procedure is suspended for all parties, by analogy to sec. 240 of the Code of Civil Procedure (Zivilprozessordnung, ZPO).

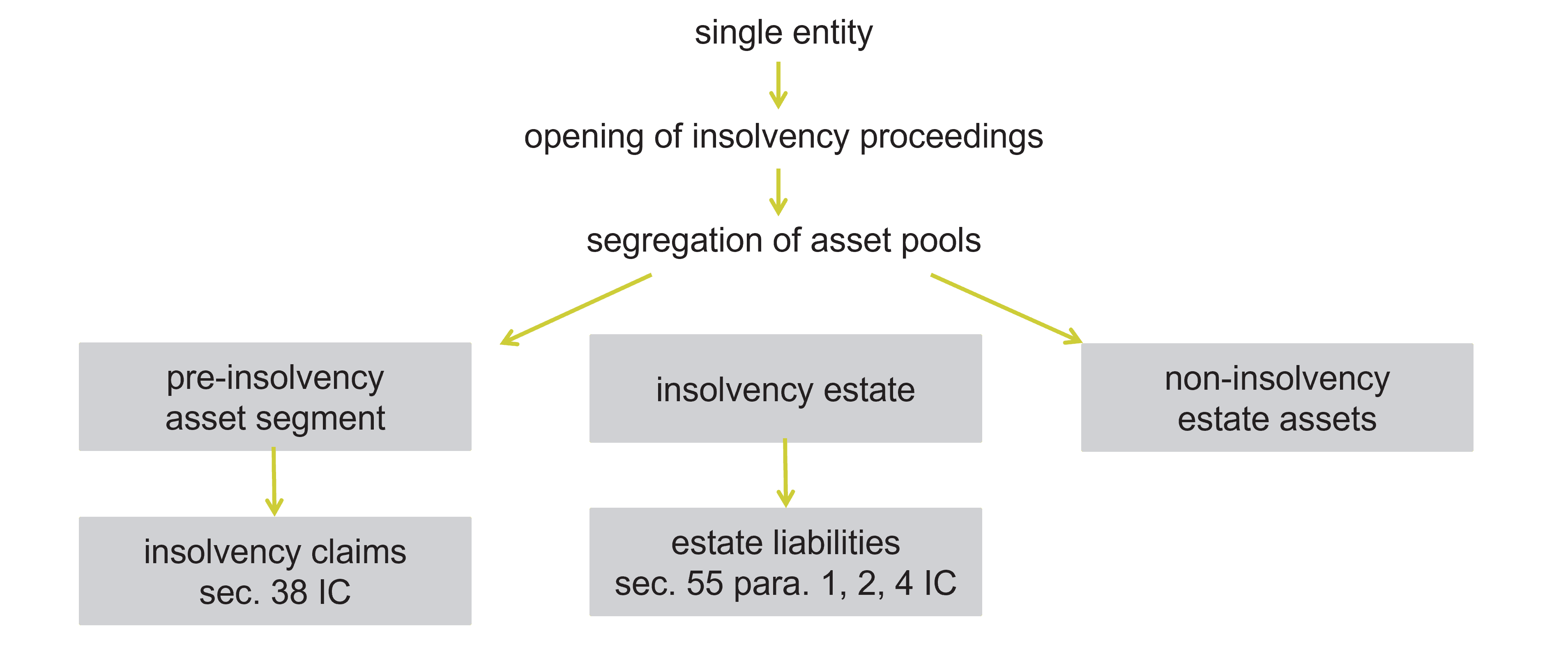

4.1.1 Insolvency – Division of asset pools – Prohibition of set-off

In enforcement proceedings, the recoverability of a tax claim depends on whether it qualifies as an insolvency claim, an estate liability (Masseverbindlichkeit), or a claim against released assets. This tripartite classification reflects the fact that, due to insolvency, a company’s formerly unified assets are divided into three distinct asset pools.

A set-off between these asset pools, for VAT purposes, is prohibited (sec. 16 of the VAT Act). Allocation is generally based on timing, although there are numerous exceptions to this rule.

4.1.1.1 Insolvency claims – sec. 38 of the Insolvency Code

As a rule, tax claims by the tax office qualify as insolvency claims if they are established prior to the opening of insolvency proceedings (cf. VAT Newsletter 05/2025: Insolvency and VAT: Payment by a Third-Party Debtor as an Insolvency Claim). The tax office must register these claims in the insolvency schedule like any other private creditor of the debtor or taxpayer. For such claims, the tax authorities are generally only entitled to a pro rata distribution. The registration of the VAT amount does not constitute a tax assessment notice, as it has no binding legal effect. In other words, the tax office cannot obtain an enforceable title against the taxpayer for the outstanding VAT, nor can it initiate enforcement proceedings (cf. Sections 87 and 89 of the Insolvency Code). If the taxpayer disputes the tax claim, the tax office may, under the conditions of sec. 251 para. 3 of the Fiscal Code, issue an administrative act to determine the insolvency claim. However, this is merely a declaratory act and not enforceable. Accordingly, enforcement measures by the tax office under the Fiscal Code are inadmissible if they conflict with insolvency law.

4.1.1.2 Estate liabilities – sec. 55 of the Insolvency Code

The other major asset pool is the insolvency estate of the taxpayer, as defined in sec. 35 para. 1 of the Insolvency Code. Tax claims that fall within the insolvency estate are referred to as estate liabilities. These are liabilities that arise during the insolvency proceedings or are explicitly listed in sec. 55 of the Insolvency Code. The tax office may assess, issue enforceable tax notices for, and enforce these estate liabilities. Classifying a tax claim as an estate liability also entitles the tax office to preferential satisfaction from the estate (cf. sec. 53 of the Insolvency Code). Estate liabilities are particularly important in VAT law, as VAT claims incurred by a preliminary insolvency administrator are classified as estate liabilities under sec. 55 para. 4 of the Insolvency Code (see also sec. 4.2.3 below).

4.1.1.3 Released assets

For the sake of completeness, the third asset pool – so-called released assets – should also be mentioned. This category is explicitly excluded from the scope of insolvency law. Tax claims relating to these assets must still be asserted directly against the taxpayer. In this context, the tax office is not subject to any enforcement restrictions. It may issue and enforce tax assessment notices.

4.1.2 Set-off in VAT insolvency law – sec. 226 of the Fiscal Code

The set-off of VAT claims under sec. 226 of the Fiscal Code results in the extinction of the claim (cf. sec. 47 of the Fiscal Code). Set-off is a commonly used tool by the tax office to unilaterally “settle” outstanding VAT claims. A frequent point of contention is whether and to what extent set-off is permissible in the context of VAT insolvency law. Insolvency law contains provisions in Section 94–96 of the Insolvency Code that may restrict the possibility of set-off. Due to the prohibition of cross-pool set-off (see sec. 4.1.1), the tax office and the taxpayer may instead attempt to achieve their desired tax outcome through the mechanism of set-off. The tax authorities often decide on the permissibility of a set-off by issuing a settlement notice (Abrechnungsbescheid) pursuant to sec. 218 para. 2 of the Fiscal Code. The taxpayer may challenge this notice by filing an objection (Einspruch) as a legal remedy.

4.1.2.1 Set-off position prior to the opening of insolvency proceedings

The tax authorities, as insolvency creditors, are generally permitted to declare a set-off without restriction if the conditions for set-off were already met before the opening of insolvency proceedings. This applies in particular to pre-insolvency VAT claims. In such cases, it is not necessary for the tax office to register these claims in the insolvency schedule.

4.1.2.2 Set-off during ongoing insolvency proceedings

If the conditions for set-off arise during the insolvency proceedings, the set-off of VAT claims by the tax authorities is generally inadmissible. It may only be permitted under the specific conditions outlined in sec. 95 para. 1 sentence 1, second half of the Insolvency Code. There are various case groups that, depending on the individual circumstances, may nonetheless allow for a set-off.

4.1.2.3 Special prohibition of set-off – sec. 96 of the Insolvency Code

In addition, the tax authorities are also bound by the prohibition of set-off under sec. 96 of the Insolvency Code. In the context of VAT insolvency law, sec. 96 no. 1 and no. 3 of the Insolvency Code are, in practice, particularly relevant. The interpretation of these provisions has been – and continues to be – the subject of numerous court decisions. The case law of the Federal Fiscal Court on this matter is extensive, meaning that handling legal disputes in this area requires a thorough analysis of the existing jurisprudence.

4.1.3 Jurisdiction of the Fiscal Courts upon commencement of insolvency proceedings

In tax disputes, the Fiscal Court retains both subject-matter and local jurisdiction, even after insolvency proceedings have been opened against the taxpayer (cf. sec. 26 sentence 3 of the Fiscal Code).

4.1.4 Insolvency administrator in VAT insolvency law

Upon the opening of insolvency proceedings, the authority to manage and dispose of the company’s assets transfers from the company’s management to the insolvency administrator (sec. 80 para. 1 of the Insolvency Code). From that point onward, the insolvency administrator assumes all VAT-related rights and obligations of the company (sec. 17 para. 11 of the VAT Application Decree). Procedurally, the insolvency administrator acts as the legal representative of the insolvent debtor in tax matters.

In VAT law, the insolvency administrator operates in two distinct roles:

As an independent entrepreneur under sec. 2 of the VAT Act, the administrator provides services in the form of insolvency administration, which qualify as “other services” under sec. 3 para. 9 of the VAT Act. For these services, the administrator typically issues invoices to the insolvent debtor that include VAT (sec. 14 of the VAT Act). This role entails all rights and obligations of a VAT-registered entrepreneur.

As an asset manager of the insolvent debtor, the administrator may also claim input VAT deductions on behalf of the debtor, based on invoices issued by the administrator. In this capacity, the administrator assumes the VAT-related rights and obligations that would otherwise apply to the debtor during the (preliminary) insolvency proceedings.

An example of an input VAT issue in insolvency is the deduction of input VAT from invoices issued by the insolvency administrator. Whether the debtor may claim input VAT depends primarily on whether the business is being wound up or continued:In the case of business discontinuation, the input VAT deduction is based on the debtor’s former business activities (Federal Fiscal Court, decision of 23 October 2024, XI R 8/22).

In the case of business continuation, the overall activity of the debtor, during the administration period, is decisive for input VAT deduction (Federal Fiscal Court, decision of 23 October 2024, XI R 20/22), provided the administrator does not engage in significant liquidation activities.

The Federal Fiscal Court has not yet ruled on cases where the administrator continues the business while simultaneously carrying out substantial liquidation measures. For a potentially more nuanced allocation approach, see the decision of the Cologne Fiscal Court (FG Köln) dated 25 May 2022 – 9 K 1278/19.

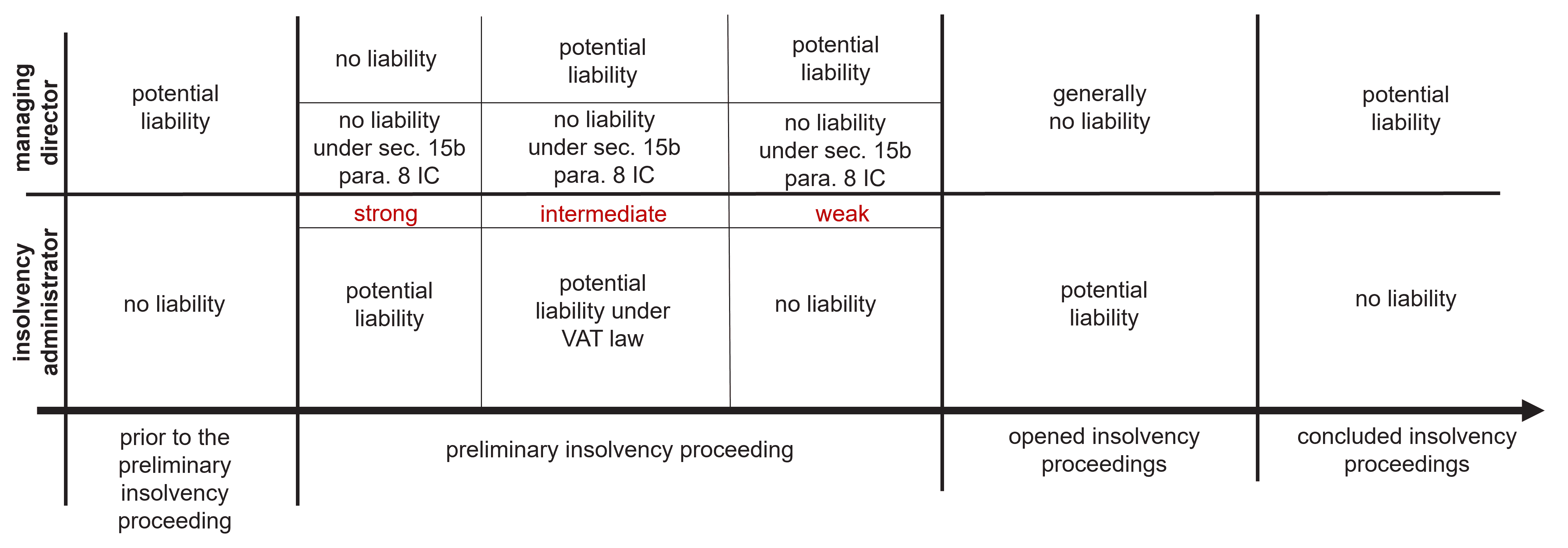

4.1.5 Liability in VAT insolvency law

Another major area of legal advisory concerns the liability for a company’s VAT debts, which may extend to shareholders, managing directors, and insolvency administrators. If a company is unable to pay its VAT liabilities due to insolvency, the tax office may seek to recover the VAT amount from a so-called liable third party (Haftungsschuldner). Such liability may apply, in particular, to the aforementioned corporate officers and the insolvency administrator responsible for the insolvent company. These parties are jointly and severally liable for the VAT debt within the meaning of sec. 44 of the Fiscal Code. The tax office may issue a liability notice (Haftungsbescheid) as soon as the VAT liability arises – even before a formal VAT assessment has been issued (sec. 191 para. 3 sentence 4 of the Fiscal Code). As a result, a managing director of an insolvent GmbH may receive a liability notice from the tax office before the VAT assessment has even been issued to the company or the tax claim has been registered in the insolvency schedule. This VAT-related liability exists alongside insolvency-related liability, meaning that liable parties may, in principle, be held accountable twice. The legislator attempted to resolve this conflict of obligations by introducing sec. 15b para. 8 of the Insolvency Code, applicable to new cases from 1 January 2021. However, this provision has not fully eliminated all conflicts, and managing directors may still face the risk of double liability for VAT debts in certain cases. In addition, liability alternates between the managing director and the insolvency administrator during the course of insolvency proceedings. This is illustrated in the following table:

See KMLZ VAT Newsletter 25/2023: VAT Insolvency Law - Subsequent Liability of the Taxable Person for VAT Debts and

KMLZ VAT Newsletter 25/2023: Insolvency and VAT: Restricted Residual Liability of Insolvent Debtors

4.2 Substantive VAT insolvency law

Substantive VAT law generally remains unaffected by insolvency regulations. However, two provisions are of essential importance in the context of VAT insolvency law:

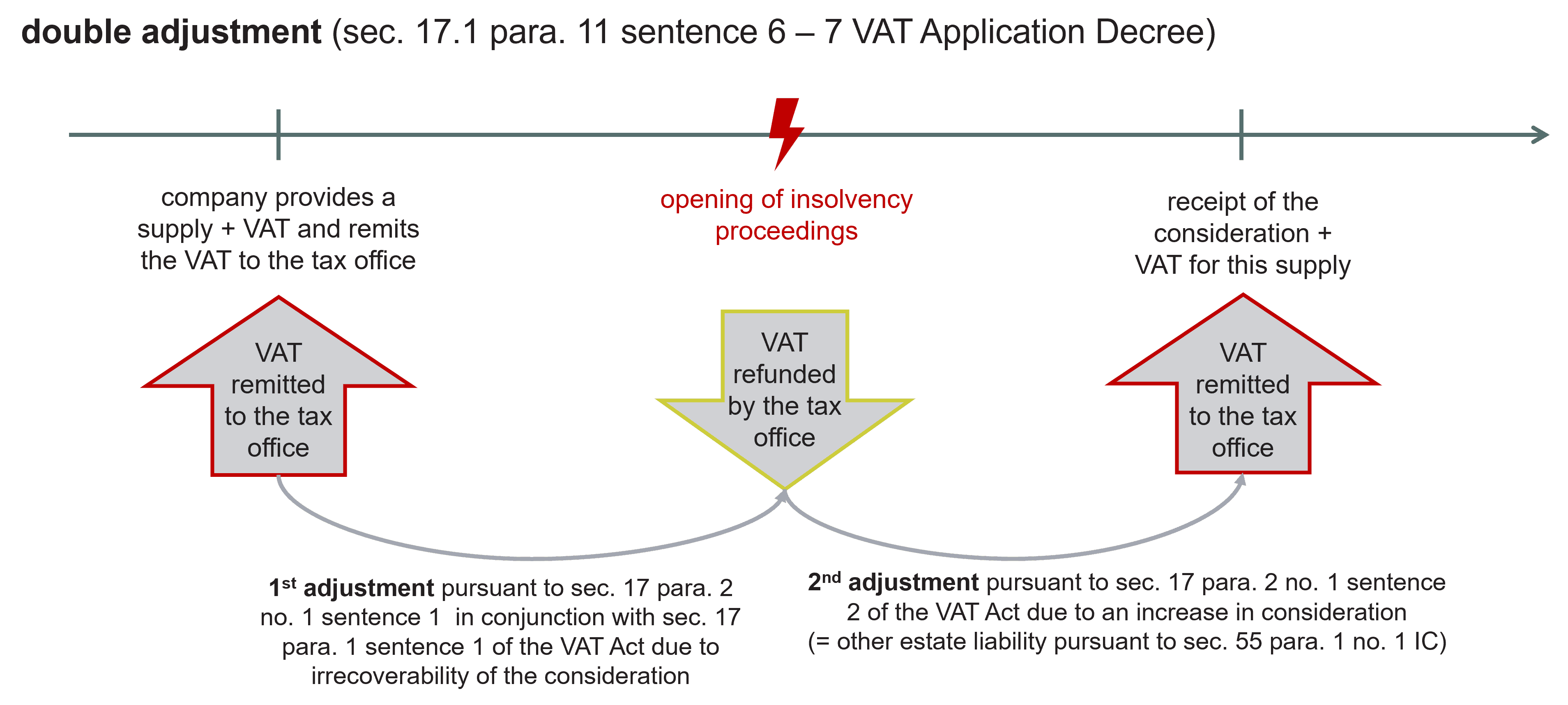

4.2.1 Legal irrecoverability under sec. 17 para. 2 no. 1 of the VAT Act: The concept of “double adjustment”

If a business experiences financial distress, its outgoing supplies, under sec. 17 of the VAT Act, may become legally irrecoverable. The insolvency-related irrecoverability of receivables for outgoing supplies constitutes a statutory case of a change in the taxable amount (sec. 17 para. 2 no. 1 in conjunction with sec. 17 para. 1 of the VAT Act). On the input side, if the taxpayer can no longer settle its liabilities, it may be required to reverse the corresponding input VAT deduction. Sec. 17 of the VAT Act provides an independent legal basis for this adjustment. However, if the taxpayer subsequently settles its liabilities or receives payment for outgoing supplies after the insolvency proceedings have been opened, a renewed adjustment under sec. 17 of the VAT Act may be necessary. The taxpayer may then be required to remit VAT or may be entitled to deduct input VAT due to the renewed change in the taxable amount. Case law and the tax authorities now agree that sec. 17 of the VAT Act applies again in such cases – this is referred to as the “double adjustment” (Doppelberichtigung).

4.2.2 Significance of sec. 55 para. 4 of the Insolvency Code for VAT law

Sec. 55 para. 4 of the Insolvency Code is one of the few provisions that directly addresses VAT insolvency law. It provides that all VAT liabilities incurred by the debtor during the preliminary insolvency proceedings – whether by a preliminary insolvency administrator, by the debtor with the administrator’s consent, or after the appointment of such an administrator – are to be treated as estate liabilities. This provision constitutes a key exception to the general principle that tax liabilities arising during the opening phase of insolvency proceedings are typically classified as insolvency claims (see sec. 3.2 above). The legislator introduced sec. 55 para. 4 of the Insolvency Code to deliberately grant the tax authorities preferential treatment over other insolvency creditors. The rationale was that the tax authorities cannot choose their debtors, and this disadvantage should be offset by the provision. A more pragmatic reason, however, is likely the fact that VAT represents the largest source of tax revenue for the federal government, and without sec. 55 para. 4 of the Insolvency Code, the state would risk losing substantial tax income.

Since sec. 55 para. 4 of the Insolvency Code constitutes an exception to the fundamental insolvency principle of equal treatment of creditors (sec. 1 of the Insolvency Code), and its interpretation and application remain a recurring issue in VAT insolvency cases. The German Federal Ministry of Finance (BMF) addressed key questions regarding the application of sec. 55 para. 4 of the Insolvency Code in its letter dated 11 January 2022 (IV A 3 - S 0550/21/10001:001, DOK 2022/0027292, see VAT Newsletter 07/2022: Federal Ministry of Finance on the treatment of VAT in preliminary insolvency proceedings). For legacy cases – i.e., insolvency proceedings filed before 1 January 2021 – transitional provisions apply.

Sec. 55 para. 4 of the Insolvency Code does not permit, either directly or by analogy, the offsetting of input VAT refund claims from the opening phase of insolvency proceedings against VAT liabilities arising during the insolvency proceedings (Federal Fiscal Court, decision of 11 December 2024, XI R 1/22).

4.2.3 Disposal of collateralized assets by the insolvency administrator (double supply and triple supply)

The disposal of collateralized assets by the insolvency administrator also involves specific VAT-related considerations. Under sec. 166 para. 1 of the Insolvency Code, the insolvency administrator has the right to dispose of assets that have been transferred by way of security (Sicherungsübereignung). The administrator sells the collateral to a purchaser and collects the proceeds for the insolvency estate. In doing so, the administrator acts as a commission agent (Kommissionär) on behalf of the secured creditor (Sicherungsnehmer).

From a VAT perspective, this process triggers three separate taxable supplies under sec. 3 of the VAT Act, commonly referred to as the “triple supply” (Dreifachumsatz):

First supply: A preliminary (deemed) supply from the insolvency estate to the secured creditor, as the latter must first obtain power of disposal over the collateral.

Second supply: A fictitious supply from the secured creditor (as principal) back to the insolvency estate.

Third supply: The final supply from the insolvency estate, via the insolvency administrator acting as commission agent, to the purchaser.

Alternatively, instead of exercising the right of disposal under sec. 166 para. 1 of the Insolvency Code, the insolvency administrator may sell the collateral, in the name of the secured creditor. From a VAT perspective, this results in what is known as a “double supply” (Doppelumsatz):

First supply: The insolvency administrator supplies the collateral to the secured creditor.

Second supply: The secured creditor then makes a separate VAT-taxable supply to the purchaser.

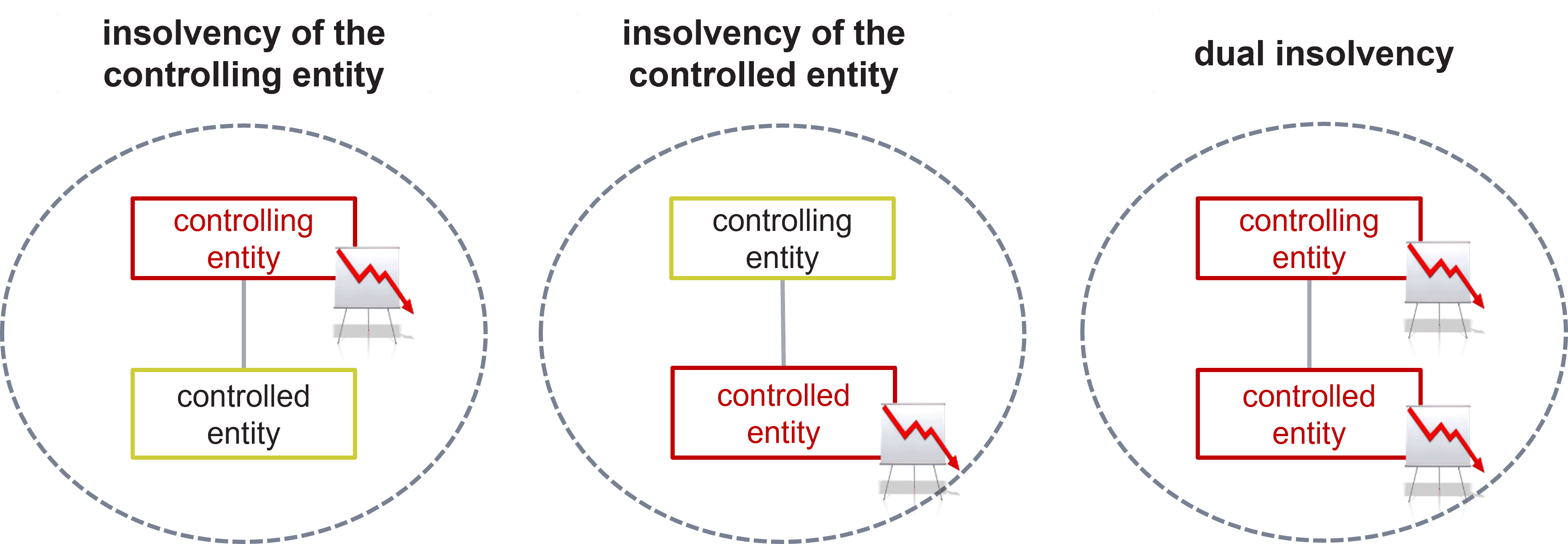

5. Insolvency in the case of a VAT group

Insolvency in the context of a (presumed) VAT group presents its own set of challenges. The legal construct of a VAT group and, in particular, its legal effects, ceases to apply upon the insolvency of at least one of the entities or persons involved.

The already complex and advisory-intensive area of VAT group taxation presents a number of special challenges in the event of insolvency. Although some fundamental legal questions have been clarified over the years, this highly intricate legal construct continues to give rise to numerous unresolved legal constellations. A frequent issue is how an insolvency administrator can not only increase the insolvency estate through insolvency-specific instruments, such as clawback actions (Insolvenzanfechtung), but also navigate VAT-related disputes arising from the dissolution of the VAT group. A recurring point of contention is who is entitled to VAT refunds – the former controlling entity (Organträger) or the former controlled entity (Organgesellschaft). In addition to cases where a VAT group is dissolved due to insolvency, practical relevance also lies in situations where a VAT group was mistakenly assumed in the past or where its existence was overlooked. In such cases, a careful case-by-case analysis is essential.

See KMLZ VAT Newsletter 14/2017: Insolvency terminates VAT group

6. Debtor-in-possession proceedings – sec. 270 et seq. of the Insolvency Code

The preceding sections have focused exclusively on standard insolvency proceedings. In contrast, debtor-in-possession proceedings, governed by Section 270–285 of the Insolvency Code, constitute a special procedure that underwent significant reform with the entry into force of the Corporate Stabilization and Restructuring Act (SanInsFoG) on 1 January 2021. This special procedure is frequently used in practice and is often chosen as an alternative to standard insolvency proceedings. In principle, the same legal provisions apply to debtor-in-possession proceedings as to regular insolvency proceedings. However, there are several important differences:

6.1 Key differences from standard insolvency proceedings

Debtor-in-possession proceedings may be initiated for corporations, partnerships, and self-employed individuals—but not for consumers. Unlike in standard insolvency proceedings, the debtor does not lose the authority to manage the business to an insolvency administrator. Instead, the debtor retains control and continues to independently manage the distressed business. This process is supervised by a court-appointed custodian (Sachwalter) pursuant to sec. 274 of the Insolvency Code. The debtor assumes, in part, the same liability responsibilities as an insolvency administrator. Debtor-in-possession proceedings may ultimately be terminated or converted into standard insolvency proceedings.

6.2 Custodian in debtor-in-possession proceedings

The custodian in debtor-in-possession proceedings primarily serves to monitor the debtor. Compared to an insolvency administrator, the custodian’s powers are significantly limited and depend on the specific authorizations granted by the court. However, with regard to insolvency clawback claims, the custodian has the same legal standing as an insolvency administrator. Many legal transactions may also require the custodian’s approval. Depending on the scope of their assigned duties, the custodian may be subject to VAT-related obligations. Unlike an insolvency administrator, the custodian is generally not considered an asset manager within the meaning of sec. 34 para. 3 of the Fiscal Code. It remains a matter of legal debate to what extent the custodian may be held liable for the debtor’s VAT liabilities.

6.3 VAT insolvency law specifics in debtor-in-possession proceedings

VAT-related specifics in debtor-in-possession proceedings are heavily shaped by case law. The Federal Fiscal Court has ruled that the initial adjustment, due to legal irrecoverability under sec. 17 para. 2 no. 1 of the VAT Act must be made upon the opening of debtor-in-possession proceedings. As a result, the system of double adjustment also applies in this context. However, it remains unresolved whether legal irrecoverability, within the meaning of sec. 17 of the VAT Act, may already occur upon the appointment of a preliminary custodian.

For debtor-in-possession proceedings filed after 1 January 2021, sec. 55 para. 4 of the Insolvency Code applies accordingly. For proceedings filed before that date, sec. 55 para. 4 of the Insolvency Code does not apply. In such legacy cases, a critical temporal distinction must be made (cf. Article 103m of the Introductory Act to the Insolvency Code – EGInsO).