With the Annual Tax Act 2020, the German legislator has implemented the so-called VAT Digital Package. The regulations on former distance have been revised and renamed (see KMLZ VAT Newsletter 35/2020: Annual Tax Act 2020 (Part 4): Regulations on distance sales to be revised, 36/2020: Annual Tax Act 2020 (Part 5): Mini-One-Stop-Shop becomes a One-Stop-Shop, 12/2021: E-Commerce: Federal Ministry of Finance comments on changes regarding distance sales as of July 2021). This particularly affects e-commerce business. However, the regulatory framework does not only apply to typical online commerce but also affects all other business models in which goods are transported across borders by the seller to private customers.

The regulatory change was part of the so-called e-commerce package. At this point in time, the previously applicable country-specific supply thresholds for distance sales were abolished and replaced by a uniform EU de minimis threshold of EUR 10,000. In order to avoid registration obligations in other EU countries for businesses as far as possible, the One-Stop-Shop (OSS) and Import One-Stop-Shop (IOSS) taxation procedures have been made available for taxable persons.

The provisions of Section 3c (1) – (5) of the German VAT Act define distance sales and determine their place of taxation. According to these provisions, distance sales are generally taxable at the place where the goods are located at the end of transport. This means that VAT is generally to be paid in the Member State where transport to the customer ends.

What is a distance sale?

A distance sale is given where…

… an item is supplied to a non-taxable person (private individual or business with a specific special VAT status)

… the goods are transported either across borders within the EU (intra-Community distance sale)

… or from a third country to a Member State (distance selling from a third country) and

… the transport is arranged by the supplier.

This refers only to the physical transport of goods. The place of residence of the parties is irrelevant.

The customer group for distance sales includes private individuals and certain taxable persons with special status who are treated as private individuals within the meaning of VAT regulations (from hereon: private individuals).

The regulations do not apply to the supply of new vehicles, the supply including commissioning or assembly of an item, and the supply of an item to which the margin scheme under Section 25a(1) or (2) of the German VAT Act applies. In the case of goods subject to excise duty, the regulations do not apply to supplies where the customer is a taxable person, even if the latter has a special VAT status.

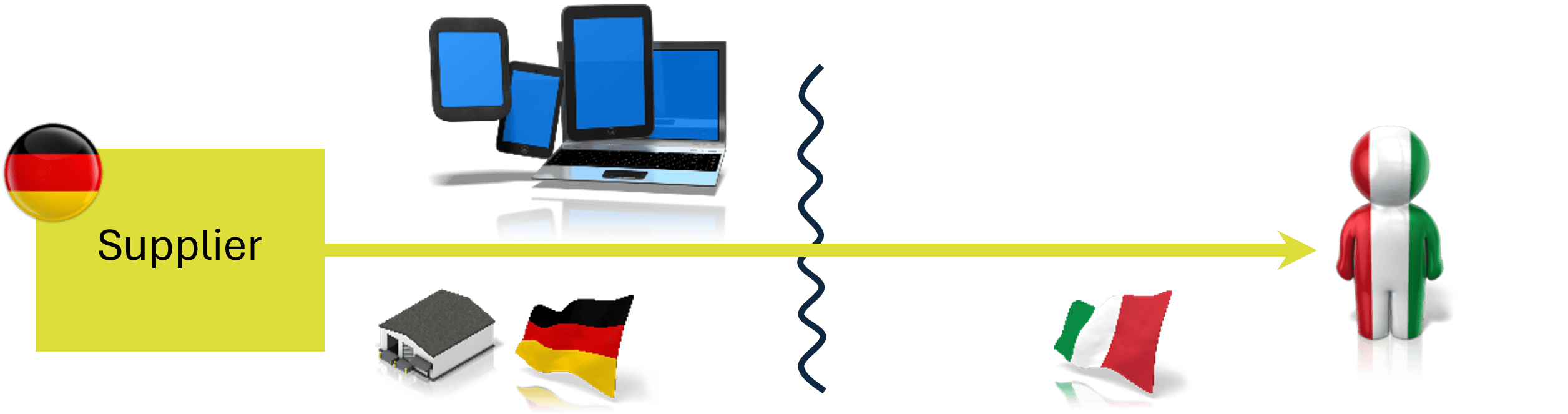

Intra-Community Distance Sales

According to Section 3c(1) of the German VAT Act, an intra-Community distance sale is the supply of goods transported by the supplier or on his behalf from the territory of one Member State to the territory of another Member State to a private individual.

Intra-Community distance sales are taxable where the goods are located at the end of transport, provided that the supplier has exceeded the threshold of EUR 10,000 in value per year or if he waives the application of the delivery threshold (see below for the de minimis threshold).

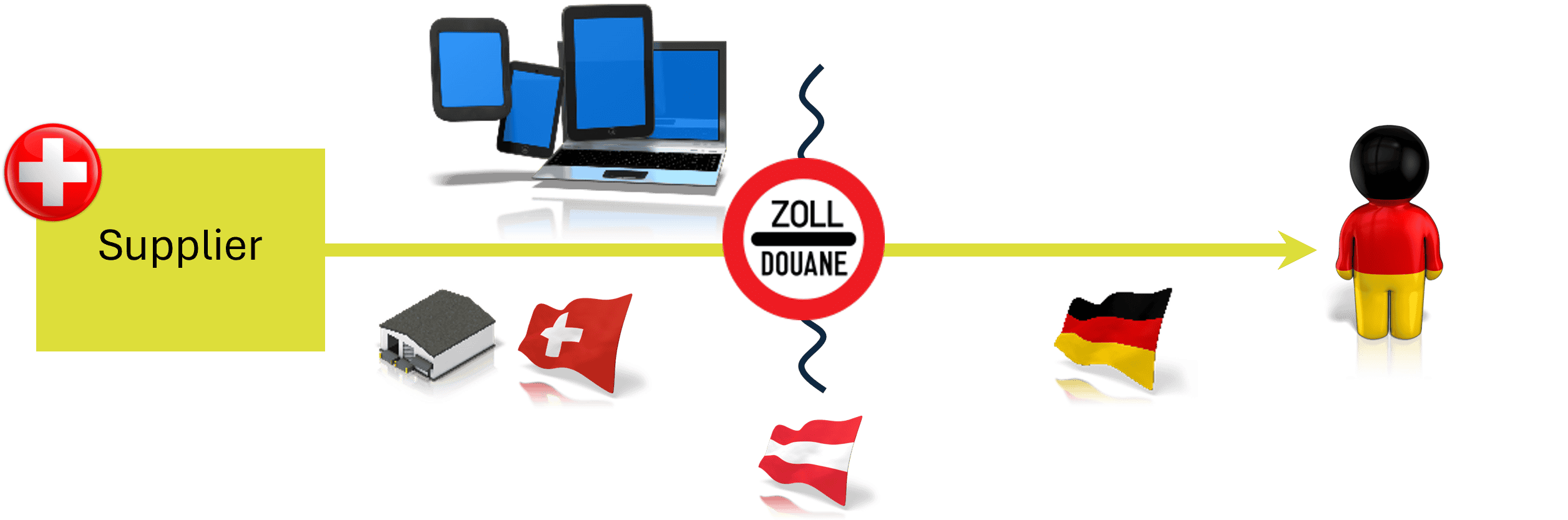

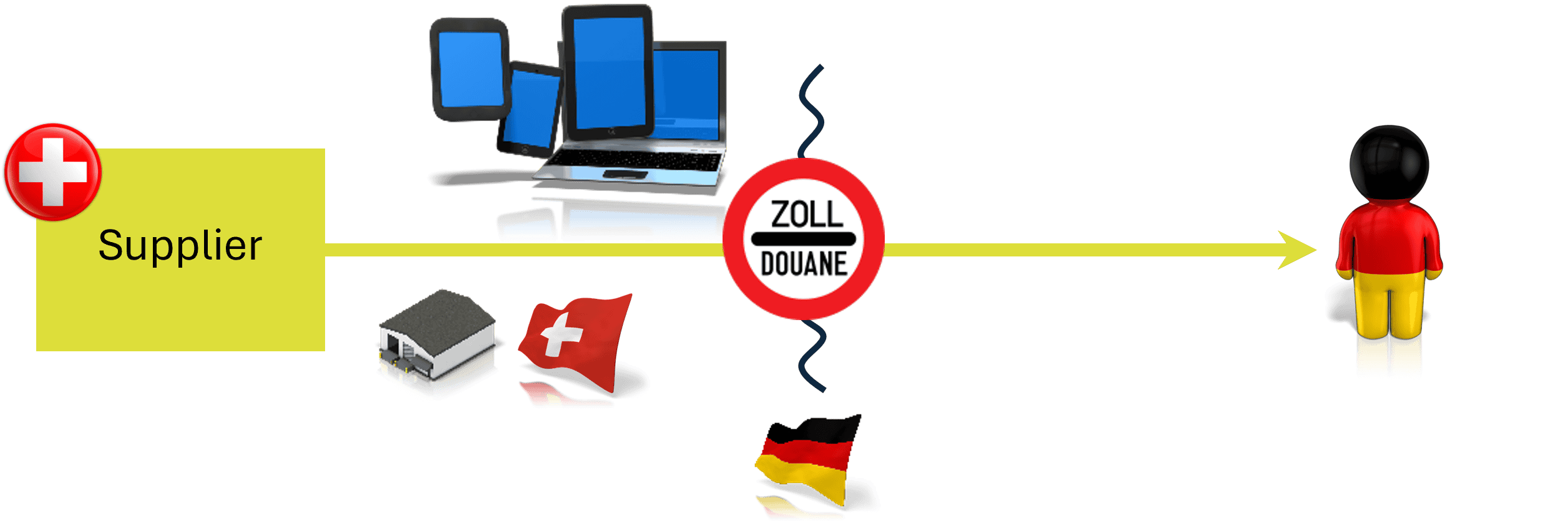

Distance Sales from a Third Country

Distance sales of goods from third countries pursuant to Section 3c (2) and (3) of the German VAT Act are also taxable in the country of destination, starting from the first transaction. Taxation as a distance sale must be applied if

the item is first imported into a Member State other than the one in which the transport or dispatch ends (Section 3c (2) German VAT Act).

or

the item is imported into the Member State where the transport or dispatch ends and the VAT is declared under the special scheme IOSS (see below in the IOSS under ‘Import Scheme’) (Section 3c (3) German VAT Act).

De minimis threshold for intra-Community distance sales

Taxation at the place of destination shall only be waived if the supplier has not exceeded the turnover threshold of EUR 10,000 per year and has not waived its application. The threshold must not have been exceeded in either the previous year or the current year. In this case, regular taxation applies to supplies involving transport. The supply is taxed at the place where transport commences (Section 3 (6) sentence 1 German VAT Act).

The de minimis threshold is a uniform EU threshold. The threshold applies to supplies from one's own territory to all other Member States and is not limited to supplies to a specific Member State (no longer a Member State-specific threshold).

However, this de minimis threshold does not apply to all businesses or all supplies:

Only businesses based within the EU and established in only one Member State benefit from the de minimis threshold. This means, among other things, that for companies from third countries (e.g. Switzerland, the United Kingdom, Norway, the People's Republic of China), the place of taxation is at the end of the transport from the first supply onwards.

The de minimis threshold only applies to intra-Community distance sales from the country of residence.

Intra-Community distance sales from other Member States are taxable at the place of destination from the first supply (e.g. when using fulfilment structures).

Distance sales from third countries are taxable at the end of transport from the first supply.

Transport arrangement

The prerequisite for the application of the distance selling rules is that the supplier arranges the transport. However, the term ‘arranging transport’ must be interpreted very broadly. This is also in line with the case law of the ECJ (see KMLZ VAT Newsletter 29/2020: ECJ: Transportation arrangement is not only based on contractual agreements). The scope of application covers not only cases where the distance seller arranges the transport, but also those where the distance seller

assumes full or partial responsibility for transport,

collects the transport costs from the customer and passes them on to the carrier, or

advertises the transport services of a carrier or provides the carrier with the necessary information.

Special VAT Treatment: Sales via electronic interfaces

In certain circumstances, taxable persons are subject to a legal fiction regarding their sales (Section 3(3a) of the German Tax Act. Under certain conditions, these companies do not supply their goods to the customer, but to the operator of an electronic interface. The latter, in turn, performs the sale to the customer. In this case, the taxable person does not owe any VAT. (See KMLZ VAT Newsletter 13/2021: E-Commerce: Federal Ministry of Finance comments on participation of online marketplaces in deemed chain transaction)

Taxable persons who support the supply of goods through the use of an electronic interface are treated as if they had acquired and supplied the goods themselves. The provision thus creates a fictitious chain transaction between the distance seller, the electronic interface (e.g. an online marketplace) and the private individual. The VAT liability is thus transferred to the electronic interface. The term ‘electronic interface’ is to be understood in a very broad sense. The scope of application includes not only electronic marketplaces, platforms or portals, but also all other comparable electronic means.

In a chain transaction, several supplies are made one after the other. In the present case, the distance seller performs a supply to the electronic interface, which in turn performs a supply to the actual customer.

However, under EU VAT law, the transport is only to be allocated to one of the supplies. In principle, the taxable person who actually carries out the transport of the goods in the supply chain is to be taken as the basis. Notwithstanding this principle, the supply by the electronic interface to the end customer always constitutes the supply with transport within the fictitious chain transaction. This applies regardless of which party (distance seller or electronic interface) transports the goods. The supply by the distance seller to the electronic interface then necessarily constitutes the supply without transport within the fictitious chain transaction. This takes place before the supply of the electronic interface to the customer and is therefore, from a EU VAT law perspective, generally taxable in the country of departure of the goods, with the following consequences:

The goods are located in a third country at the time of the start of transport: From a EU VAT law perspective, the supply is not taxable within the EU.

The goods are located in the EU at the time of the start of transport: The supply by the third-country taxable person is taxable in the Community territory but zero-rated (Section 4 No. 4c German VAT Act; Article 136a VAT Directive). This is a zero-rated transaction that does not lead to a prohibition on deducting input VAT from the purchase transaction.

In the case of a distance sale via an electronic interface, the place of taxation for the supply with transport is in the country of destination.

Use Cases

The provisions of Section 3(3a) of the German VAT Act apply in the following two cases:

Distance selling of goods imported from third countries in consignments with a material value of no more than EUR 150. Example: Shipment of goods with a value of EUR 100 from a taxable person in Switzerland to a private individual in Germany.

Supplies of goods by a non-established taxable person to a private individual, where the transport or dispatch of the goods commences and ends within the Community. Example: dispatch of goods by a Swiss trader from a warehouse in the EU to a private individual in Germany.

Special Scheme: One-Stop-Shop

Cross-border distance sales are taxable where the customer is located. This entails increased bureaucracy for the supplier, who must then register in every Member State to which they supply goods or provide other taxable services. They must then declare and pay VAT in the respective Member State.

At this point, taxable persons have the option of special schemes as an alternative to the regular taxation procedure, which minimise their administrative burden.

The Mini One Stop Shop (MOSS) procedure introduced in 2015 was expanded in 2021 and has grown into the One Stop Shop (OSS). OSS is a special scheme that enables a taxable person to pay VAT owed in other Member States countries centrally. This is intended to avoid registration in several Member States. EU businesses have the option of fulfilling their reporting obligations for other Member States in their own country of residence.

See KMLZ VAT Newsletter 27/2021: Distance Sales: OSS procedure and still compulsory registration in other EU Member States?

Participation in the OSS is voluntary. Regular VAT registration (assessment procedure) in other EU countries and OSS are not mutually exclusive. A taxable person can report supplies in the assessment procedure in another EU Member State if they are required to register there for other reasons (e.g. intra-Community transfers or local sales). Taxable persons can declare their distance sales in the OSS in parallel to the assessment procedure in other EU countries. Existing VAT registrations do not affect the use of OSS/IOSS. The only requirement is that all transactions within an OSS procedure are reported uniformly in the OSS.

Within the OSS, there is a ‘non-EU Scheme’, an ‘EU Scheme’ and an ‘Import Scheme’.

„Non-EU-Scheme“

Third-country taxable persons can report all supplies of services to private individuals that are taxable in the EU via OSS.

This means that, in addition to electronically supplied services, the following services can also be reported via OSS: real estate, cultural and entertainment services, restaurant services, intermediary services, event services, work on movable property and its appraisal, as well as passenger transport and the long-term rental of means of transport. The prerequisite is that the services are supplied to non-business customers. This covers all services supplied to non-business customers.

„EU-Scheme“

The EU regulation covers three different types of transactions:

EU businesses are able to report all supply of services to private individuals that are taxable in another Member State in their country of residence (this includes the supply of services mentioned above).

Both non-EU businesses and EU businesses can report their intra-Community distance sales via OSS. However, this is not possible for intra-Community transfers of own goods.

Supplies within a Member State that is subject to the chain transaction fiction of Section 3(3a) of the German VAT Act (Article 14a of the VAT Directive) can also be reported by the online marketplace in the OSS.

„Import-Scheme“

Both EU taxable persons and third-country taxable persons can report distance sales of consignments with a material value of no more than EUR 150 in the IOSS (known as the ‘Import One-Stop Shop’, or ‘IOSS’ for short, part of the OSS). In this case, the import of the goods remains VAT-exempt in accordance with Section 4 (1) No. 7 of the German VAT Act (Article 143 (1) (ca) of the VAT Directive). A further prerequisite for VAT-exempt importation is that the validity of the individual identification number of the taxable person or their IOSS-representative (a taxable person not established in the EU needs a representative if their country is not whitelisted) is checked by the customs office when the customs declaration is made. This additional identification number is issued by the competent customs office at the request of a taxable person. It must be distinguished from an EORI or VAT identification number and is only valid for the declaration of supplies in the IOSS.

Reporting Period

Returns under the non-EU and EU regulations in the OSS must be submitted quarterly. The deadlines for submitting declarations via OSS and the due date for VAT payments expire at the end of the month following the quarter (e.g. on 30 April for the first quarter). Furthermore, businesses are allowed to make corrections in the current OSS return. There is no need to correct the OSS return that has already been submitted.

Declarations under the IOSS, on the other hand, must be submitted monthly. The deadlines for submitting declarations via IOSS and the due date for the tax liability therefore expire at the end of the month following the reporting month (e.g. on 28 February for January).

Disadvantages of OSS in practice

Limited reportable transactions

Unfortunately, the type of transactions that can be declared in the OSS is limited. Some types of transactions still cannot be reported in the OSS:

Intra-Community acquisitions

Intra-Community supplies of own goods

Local supplies, e.g. from a warehouse in the same Member State (exception: online marketplaces)

Local purchases

Excise duties

Environmental, green and packaging taxes, etc.

Use of fulfilment structures

Many distance sellers use fulfilment structures (e.g. storage of goods via an online marketplace). In such structures, goods are moved back and forth between different warehouses in order to achieve the best possible logistical setup. If these warehouses are located in different Member States, these movements of goods generate taxable intra-Community transfers of own goods. These transactions cannot be reported via OSS. These transactions are subject to registration in each Member State in which a warehouse is located. Furthermore, it cannot be ruled out that the warehouse from which the goods are supplied and the customer are located in the same Member State. These transactions cannot be reported via OSS either. If a distance seller uses such structures, the registration requirement in the warehouse countries remains. In this case, the distance seller must accept parallel structures when reporting transactions (distance sales via OSS, intra-Community transfers of own goods and local transactions under the regular procedure).

Distance seller with simple logistics chains benefit from OSS. However, if a business has more complicated logistics structures, there is no way to avoid different reports in other EU countries. In this case, it is essential that the accounting structures are set up in such a way that the sales are included in the correct declaration (OSS and VAT returns in other EU countries).

Input VAT deduction

It is not possible to report input transactions in the OSS. If you therefore reduce your registrations in other EU countries as much as possible, the only option available to you as a taxable person is filing a claim according to 9th Directive or 13th Directive in order to obtain a refund of input VAT in other Member States. This is associated with a significant cash flow disadvantage, as the processing of refund applications is extremely formal and can often take more than a calendar year.

Contact