1 Key statements from the jurisprudence

Direct consumption of electricity

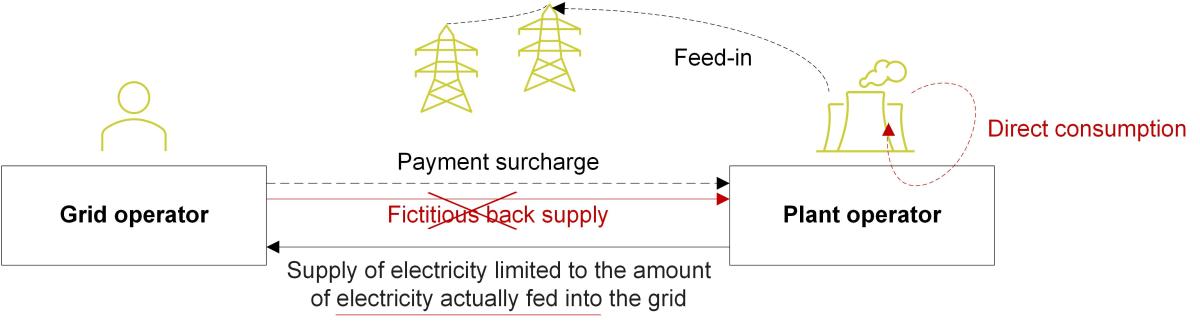

If an operator of an energy generation plant generates electricity and consumes it himself, practice has so far assumed a back and forth supply of electricity in circumstances where he received a subsidy for this in accordance with the Renewable Energies Act (EEG) or Combined Heat and Power Act (KWKG). The plant operator therefore fictitiously supplied the electricity he consumed himself to the grid operator. The grid operator then fictitiously supplied the electricity back to the system operator. Insofar as they are taxable persons subject to regular VAT-taxation, both paid VAT on the supply of goods and were able to claim an input VAT deduction from the respective purchase of the electricity – if they were generally entitled to deduct input VAT. If the plant and grid operators were resellers within the meaning of sec. 13b para. 5 s. 4 and sec. 3g of the German VAT Act, they had to apply the reverse charge mechanism to the respective supply of goods.

The Federal Fiscal Court found this practice to be incorrect in its decisions of 29 November 2022 and 11 May 2023. The Court states that the grid operator does not obtain any right to dispose of the electricity consumed on a decentralised basis. As a result, there is neither a supply of electricity to him nor a return supply from him to the plant operator.

Supply of heat without consideration

If a CHP plant operator (eg cogeneration unit or a biogas plant) withdraws self-generated heat for his non-taxable business purposes and this use results in a taxable supply carried out free of charge, the taxable amount is generally determined according to the (fictitious) purchase price for the heat. If a (fictitious) purchase price cannot be determined, the cost price (including production, acquisition and financing costs) must be used as the taxable amount. However, if the cost price is incurred for consideration for the supply of electricity and heat free of charge, it must be split between electricity and heat.

To date, the administration has provided for a breakdown according to the ratio of the quantities of electrical and thermal energy generated in kWh. However, in its two judgments of 15 March 2022 and 9 November 2022, the Federal Fiscal Court now assumes that the energy-based apportionment method is no longer applicable. Instead, the apportionment must be based on the actual or fictitious supplies (market values). This is to be based on “fictitious sales transactions”.

2 Amendments to sec. 2.5. of the German Administrative VAT Guidelines

Good things come to those who wait. In its letter dated 31 March 2025, the Federal Ministry of Finance now agrees with the Federal Fiscal Court’s view and has changed its previous view on the following aspects:

| Previous | New |

|---|---|

|

|

|

|

|

|

|

|

|

|

3 Consequences for the practice

The Federal Ministry of Finance’s letter, which is favourable for the energy sector, must be applied to all open cases. However, non-objection regulations apply to supplies carried out prior to 1 January 2026. The previous regulations can continue to be applied to these supplies and both plant and grid operators may treat the CHP surcharge for direct marketing as consideration subject to German VAT.

The back and forth supplies were particularly unfavourable for taxable persons not entitled to deduct input VAT (such as those falling within the scope of sect. 2 para. 3 of the German VAT act old version public law entities in the sovereign sector, eg sewage treatment plants), as they are ultimately burdened with VAT. These taxable persons should endeavour to apply the new principles as early as possible. Furthermore, plant and grid operators should review their VAT procedures as soon as possible and adapt them to the new jurisprudence and administrative practice by 1 January 2026 at the latest in order to avoid the threat of VAT and input VAT risks due to incorrectly shown VAT on invoices.