The Federal Fiscal Court ruled on the following facts:

1. Facts

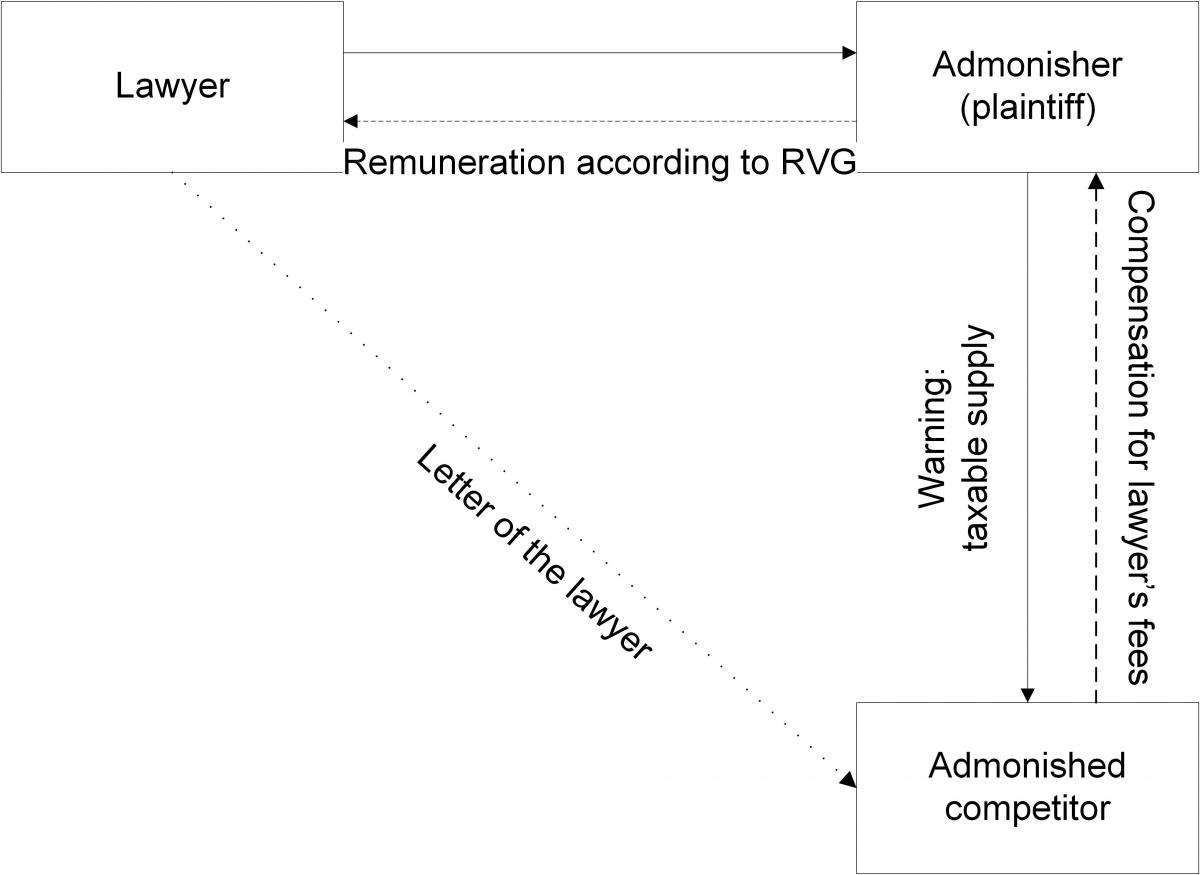

The plaintiff worked, inter alia, in the hardware and software trading field. In the relevant years, she warned and claimed injunctive relief against competitors pursuant to the Act Against Unfair Competition due to wrongful terms and conditions. The plaintiff engaged a lawyer to assist her in this process. The competitors against whom injunctive relief was sought ultimately refunded the plaintiff’s legal fees exclusive of VAT. The amount of the fees was directly transferred from the competitors to the lawyer’s account. The VAT amount was duly paid by the plaintiff to the lawyer and later deducted by the plaintiff.

After a special VAT audit, the tax office considered that the plaintiff had provided a taxable supply to the respective competitors by issuing them with a warning pursuant to the Act . The Fiscal Court Münster allowed the plaintiff’s appeal (judgment of 03 April 2014 – 5 K 2386/11 U). The court found that there was no supply of services.

The Federal Fiscal Court, however, dismissed the judgment of the Fiscal Court Münster and dismissed the appeal.

2. Reasons for the decision

The Federal Fiscal Court found that the warning was indeed a taxable supply, which the plaintiff provided to the respective warned competitors in exchange for payment.

Prior to an entrepreneur taking action against a competitor for unfair competition, he shall first admonish him on the basis of sec. 12 para. 1 sentence 1 of the Act Against Unfair Competition. This involves the entrepreneur communicating a cease and desist declaration to the competitor thereby affording the competitor an opportunity to settle the dispute. The entrepreneur is entitled to demand reimbursement of any necessary expenses which he has incurred in complying with this legislative requirement.

According to the case law of the civil courts, the issuance of a warning usually serves the best interests of both parties. It is intended to terminate the dispute in a simple, cost-effective manner prior to any proceedings being instituted, thereby avoiding a formal legal dispute. By issuing the warnings, the plaintiff provided a concrete advantage to its competitors, ie the avoidance of a legal dispute, and, as a result, a service was supplied by the entrepreneur to his competitors, within the meaning of the VAT law.

3. Conclusion

It seems questionable whether a warning would actually constitute an economic advantage for the party being admonished. Looking at it from the average consumer’s point of view, it is unlikely that he/she would feel enriched with an advantage in these circumstances. In addition, it is worth noting that a reminder is not classified as a taxable supply (see sec. 1.3 para. 6 sentence 2 VAT Circular). A reminder that an invoice is due also ultimately serves to avoid further legal dispute. It would have been interesting to know the ECJ's view on this issue. Nevertheless entrepreneurs will need to take into account the Federal Fiscal Court’s case law regarding warnings made pursuant to the Act Against Unfair Competition.

It seems extremely doubtful whether this case law concerning the Act Against Unfair Competition can ultimately be transferred to other areas, such as, for example, trademark or copyright law. Entrepreneurs who issue warnings in these areas do so with the intention of warding off any intervention by the party admonished as regards their intellectual property. They certainly do not intend to give the infringer any advantage. Here, a clear positioning of the courts would be desirable.