1 Background

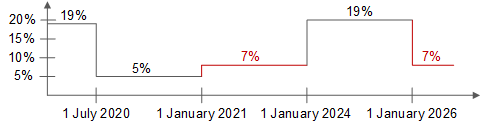

As a temporary crisis measure, a reduced VAT rate for the supply of restaurant and catering services (with the exception of beverages) was put in place from 1 July 2020 to 31 December 2023.

In conjunction with the general VAT rate reduction, in the second half of 2020, the VAT rate was therefore only 5%. At the time, the grounds for the decision to reduce the VAT rate was the necessity to provide economic support to the restaurant industry, as a result of the corona pandemic. The measure, which was originally limited until 30 June 2021, was subsequently extended several times. This decision was accompanied by various German Federal Ministry of Finance letters.

Now it is time to take such action again: The legislator wants to reduce the VAT rate for the supply of restaurant and catering services (with the exception of the sale of beverages), commencing on 1 January 2026. This measure, and several other changes in VAT law, are planned in the draft 2025 Tax Amendment Act.

2 Reduced VAT rate for the supply of restaurant and catering services

With the amendment to sec. 12 para. 2 no. 15 of the German VAT Act, the supply of restaurant and catering services, with the exception of the sale of beverages, carried out after 31 December 2025 will be permanently subject to the reduced VAT rate.

The objective of the measure is to provide economic support to the restaurant industry. In addition, distortions of competition are to be avoided, as the reduced VAT rate already applies to both food delivered and taken away. Restaurants near the border of all neighbouring countries will be particularly pleased about this, as they have suffered greatly in the past due to the fact that adjoining countries have all offered benefits to encourage restaurant visits. Germany is the only country that has not done so as yet.

Even if, from a dogmatic point of view, any reduced VAT rate is a problem and the reduction is a real problem in times of difficult budgetary situations, the reduced VAT rate also has something good about it: the old question, “eat in or take away?” is finally a thing of the past, at least from a VAT perspective.

In the past, there were ongoing difficulties in distinguishing between the supply of food containing significant elements of supplies of services, which were subject to the regular VAT rate, and the supply of food lacking these significant elements of supplies of services, which were subject to the reduced VAT rate. With the introduction of the 7% VAT rate on restaurant and catering services, these difficulties, in distinguishing between the two, will no longer exist. This will have a particularly beneficial effect on the supply of catering services, nursery and school meals, and hospital catering.

3 Challenges

It would be helpful if a German Federal Ministry of Finance letter were to accompany the legislative measure so that the legislative objective is fully achieved. Similar to the Ministry’s letter of 2 July 2020, a simplification rule should be found for combination offers of food, including beverages, (e.g. buffets, all-inclusive offers) by applying a percentage of the flat rate price to the remuneration component attributable to beverages. It is recommended that restaurant vouchers should, as of now, no longer be issued as single-purpose vouchers, but as multi-purpose vouchers, e.g. by allowing them to be redeemed for takeaway food as well. In this case, VAT would only be incurred at the time the voucher is redeemed. If the voucher is not redeemed until 2026, the restaurant will benefit from the reduced VAT rate on food.

4 Further measures planned in the Tax Amendment Act

In addition, electronic notification of assessments is to be made possible in the context of the input VAT refund procedure. The legislator is planning special provisions in the German VAT Act (new sec. 21b) for the use of centralised customs clearance. Apart from VAT, the draft law provides for increasing the mileage allowance for journeys between home and work, removing the time limitation on the mobility premium, and interesting relief for non-profit organisations: an increase in the exemption threshold for economic business operations, an increase in the allowance for trainers and volunteers, and an increase in the threshold for the obligation to use funds in a timely manner, as well as the elimination of the requirement to allocate income to specific spheres for smaller entities. And, very importantly, in the future, e-sports are to become non-profit. This will enable our children to pursue their electronic hobbies within non-profit organisations.

Contact:

Lawyer, Certified Tax Consultant,

Certified Public Accountant

Tel.: +49 89 217501230

As per: 19.09.2025