1 Background

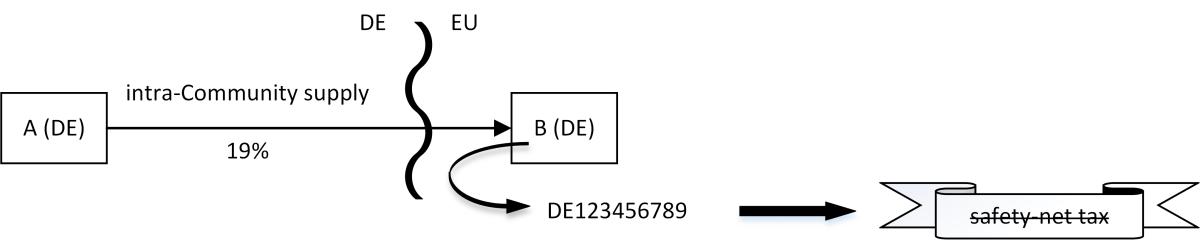

An intra-Community acquisition is deemed to be effected where the transport ends, see Art. 40 EU VAT Directive (sec. 3d sent. 1 of the German VAT Act (UStG)). Acquisition tax then arises at this point (as a rule, without payment burden due to corresponding input VAT deduction). If the purchaser does not use his VAT-ID of the country of destination, vis-à-vis the supplier, but rather a VAT-ID allocated to him by another Member State, a further acquisition tax arises on the basis of Art. 41 EU VAT Directive (sec. 3d sent. 2 UStG), provided there is no triangular transaction. Since this acquisition tax may not be deducted as input VAT, the acquirer must also pay acquisition tax in the Member State from which the "incorrectly" used VAT-ID originates, until such time that he is able to prove that the acquisition was taxed in the correct country.

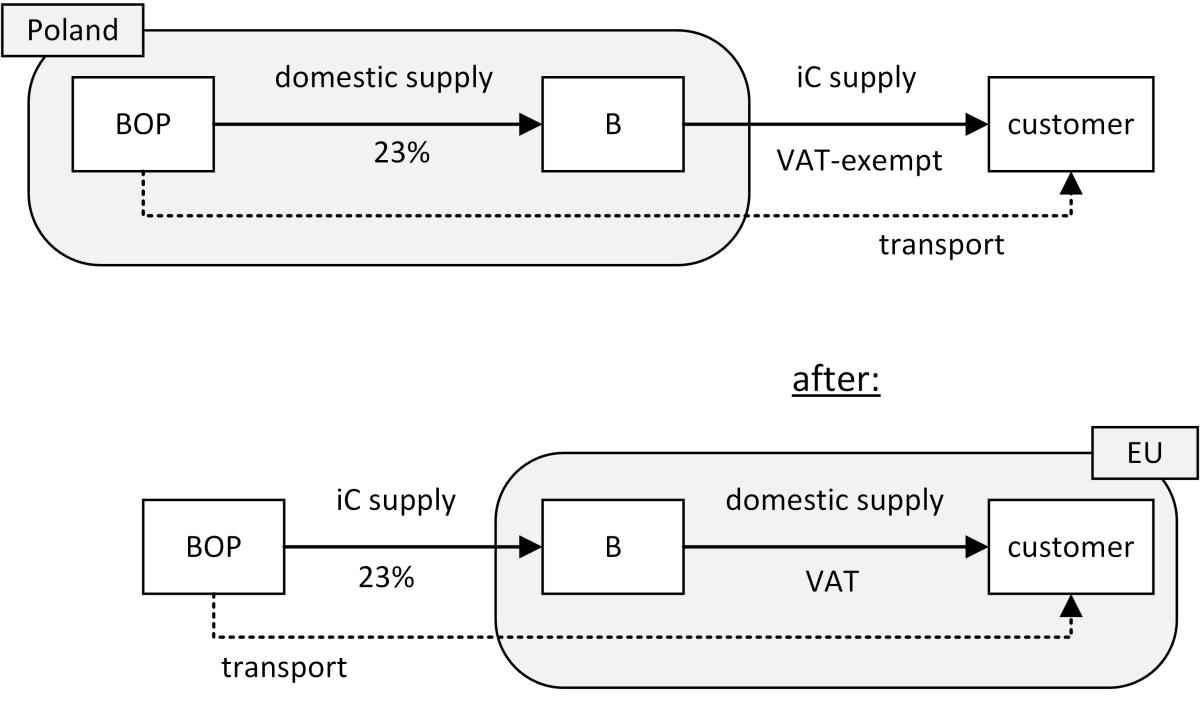

The danger of this so-called safety-net acquisition tax exists, in particular, in the instance of chain transactions where the transport is incorrectly allocated, as was the situation in the case recently decided by the ECJ (C-696/20). Here, the parties involved had allocated the transport to the second supply (B to customer) instead of to the first supply (BOP to B). B, a Dutch company registered for VAT in Poland, acted using its Polish VAT number.

2 Use of VAT-ID from country of departure

First of all, the ECJ held that Art. 41 VAT Directive is applicable even if the VAT-ID used by the acquirer originates from the country of departure. Previously, some doubt existed among tax experts as to whether this was possible. This issue should now be resolved.

3 Objective of the safety-net acquisition tax is decisive

In a second step, the ECJ examined whether the application of Art. 41 VAT Directive, in the case at hand, was in line with the objective of the provision. It reiterated its findings in Facet (C-536/08 and C-539/08), according to which the provision seeks, firstly, to ensure that a given intra-Community acquisition is subject to tax and, secondly, to prevent double taxation in respect of the same acquisition. B had argued that although the acquisition was not taxed by it in the country of destination, it was taxed by the customers there. The referring Polish court therefore asked whether double taxation had occurred in this respect, which would, in this instance, argue against the application of Art. 41 VAT Directive. However, the ECJ did not accept this argument. It differentiated between the acquisition by B of the first supply and the separate supply to the customers in the second leg of the transaction. The taxation of the acquisitions by the customers was therefore irrelevant.

4 Infringement of the principles of proportionality and fiscal neutrality

Ultimately, the ECJ nevertheless came to the conclusion that Art. 41 VAT Directive is not applicable, because otherwise double taxation would occur, which is not in line with the principles of proportionality and fiscal neutrality. BOP had had to charge Polish VAT to B because B had used its Polish VAT ID number vis-à-vis BOP, although an intra-Community supply had taken place. However, according to the facts determined by the referring court, B was not permitted to deduct this as input VAT. Together with the safety-net acquisition tax, B therefore was required to pay 46% VAT.

5 Conclusions

The ECJ has considerably restricted the scope of application of Art. 41 VAT Directive (sec. 3d sent. 2 UStG) and not just in the case of chain transactions. It will now also no longer be possible in two-party constellations for safety-net acquisition tax to arise if the acquirer uses his VAT-ID of the country of departure and the supplier also charges VAT to the acquirer, which the acquirer cannot deduct as input VAT (e.g. unduly charged VAT, sec. 14c UStG).

Overall, however, some questions remain. For example, it is unclear whether only cases before the introduction of the quick fixes are likely to be affected. In the case of a VAT legally owed by the supplier, e.g. since 01.01.2020 due to a non VAT-exempt intra-Community supply (because the acquirer did not use a foreign VAT-ID), no double taxation should ultimately arise due to the existence of an input VAT deduction right in this respect. It is also questionable whether the decision on the Polish case can be applied to German law. A VAT liability under sec. 14c UStG can be subsequently corrected and thus the double taxation could be eliminated. On the other hand, the safety-net tax could also be eliminated by subsequently declaring the intra-Community acquisition in the country of destination. However, the ECJ considered this to be irrelevant.

Contact:

Ronny Langer

Certified Tax Consultant, Dipl.-Finanzwirt (FH)

Phone: +49 89 217501250

ronny.langer@kmlz.de

As per: 19.07.2022