1 Renewed extension of the submission deadline for the annual VAT return 2020

The coronavirus pandemic has had a variety of effects. In addition to the introduction of various special tax schemes, the general deadlines for submitting tax returns have, in recent years, also been extended several times. In view of the burdens caused by the ongoing coronavirus pandemic, the Ukraine crisis and the property tax reform, the legislator has decided to, once again, extend the submission deadlines for the 2020 annual returns. Thus, the 2020 annual VAT return can now still be submitted up until 31 August 2022, provided the taxable person has sought professional tax advice. The extension of the deadlines results from the “Fourth Act on the Implementation of Tax Relief Measures to Cope with the Coronavirus Crisis” (Fourth Corona Tax Relief Act, Federal Law Gazette I p. 911), which was passed on 19 June 2022. What is remarkable here is: The law on the extension of the filing deadline was not promulgated until the filing deadline had expired. However, few taxable persons or advisors will be bothered by this legislative peculiarity but will rather be pleased about the renewed extension of the deadline. The Fourth Corona Tax Relief Act provides for an extension of the deadline not only for the year 2020, but also for the following years.

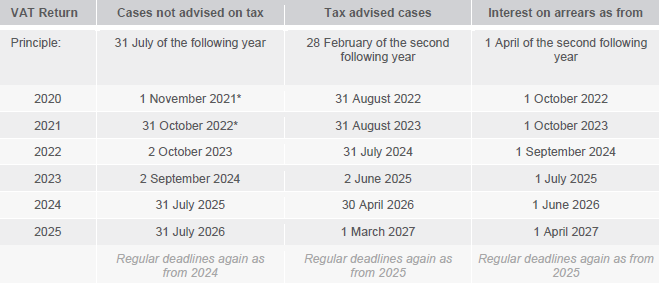

2 Amended submission deadlines for annual VAT returns until 2025

According to this decision made by the legislator, extended deadlines for the submission of annual VAT returns will apply for the next few years, too. The extended filing deadlines are to be gradually withdrawn concluding in 2025. In this way, processing backlogs, that have arisen with taxable persons, advisors and tax offices, are to be reduced. The legislator has adapted the deadlines for both taxable persons filing their own tax returns, as well as for those seeking tax advice. An overview of the deviating deadlines for the annual VAT returns up to and including 2025 can be found below.

3 No extension of the deadlines for periodic VAT returns

The generous extension of the deadlines has been universally welcomed. It is precisely the early announcement that provides planning security for both taxable persons and advisers. Please note: The deadlines for filing periodic VAT returns, EC Sales Lists and Intrastat reports are not affected by the extension. The pre-existing tight deadlines continue to apply to these declarations. If a taxable person wishes to gain more time, the only option available is to apply for a permanent extension of the deadline for filing the periodic VAT return, in which case a special advance payment may become due. In accordance with sec. 18a of the German VAT Act, there is, however, no possibility to obtain a permanent extension of the deadline for filing EC Sales Lists. The same applies for Intrastat reports.

4 Extension of the interest-free grace period

In addition to the submission deadlines, the interest-free grace period has also been extended in accordance with sec. 233a para. 2 of the German Fiscal Code. This is an indispensable step in the case of an extension of the submission deadlines. Otherwise, interest would accrue during the regular interest-free period of 15 months, despite the tax return not yet being due for submission. The interest-free grace period does not distinguish between taxable persons submitting their own tax returns and taxable persons who have them submitted on their behalf by a professional tax consultant. The interest-free period now ends approximately one month after the expiry of the (extended) submission deadline for the annual VAT return. For 2020, for example, the interest period will commence on 1 October 2022.

5 Late filing penalties

In accordance with sec. 152 para. 2 of the German Fiscal Code, late filing penalties automatically become due if the annual VAT return is filed late and results in a VAT liability. Here, the tax offices have no scope of discretion but must assess the late filing penalties accordingly. Even if the late submission of the annual VAT return does not lead to an additional payment, a late filing penalty can, nevertheless, be assessed according to the current legal situation. In these cases, the assessment is at the discretion of the respective tax office (sec. 152 para. 3 no. 2 in conjunction with para. 5 of the German Fiscal Code).

6 Overview: Submission deadlines for annual VAT returns until 2025

*The deadline differs in federal states where the date is a public holiday (sec. 108 para. 3 of the German Fiscal Code).

Contact:

Bettina Finken

Lawyer, Dipl.-Finanzwirtin (FH)

Tel.: +49 211 54095346

As per: 01.07.2022